SPECIAL REPORT: Brazil (PREMIUM-UNLOCKED)

The following post was originally issued to premium TLS members on May 18.

Key Chart Levels On Brazil & Latin America

Just when we thought we were seeing a spike in volatility in the U.S. equity market yesterday, Brazil shows us today what volatility really is (it’s down ~10%). This is just a quick post pointing out key potential support levels for those considering catching the knife in Brazilian and Latin American stocks:

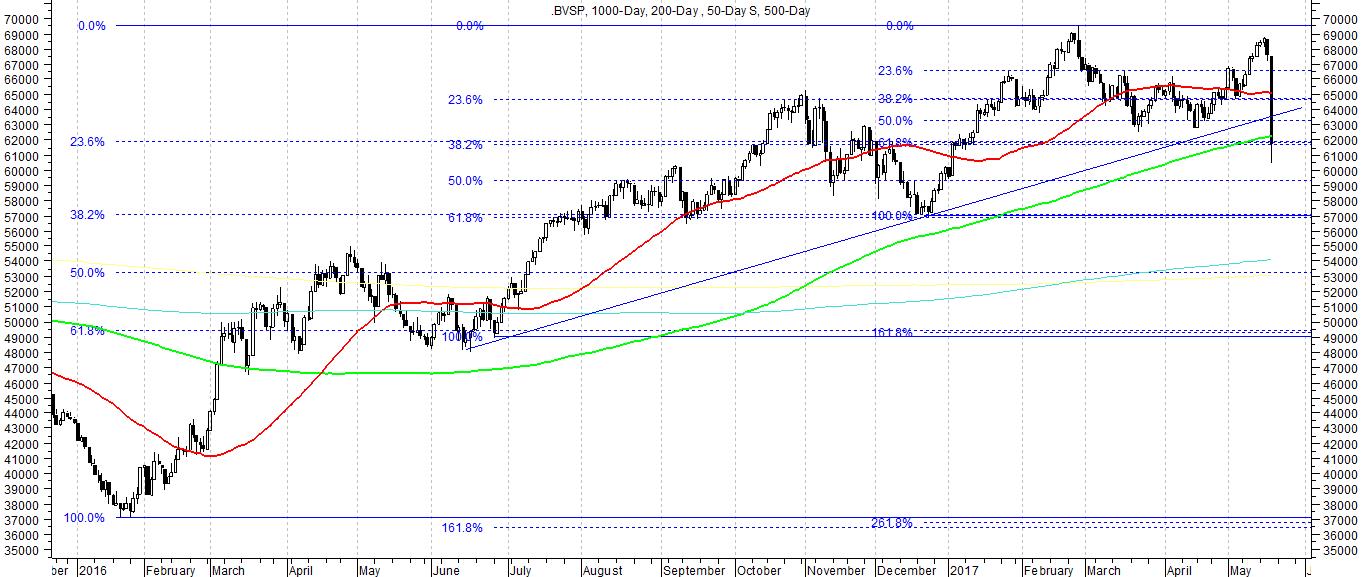

Brazilian Bovespa:

Key Support Levels: 61,700, 57,000, 49,000

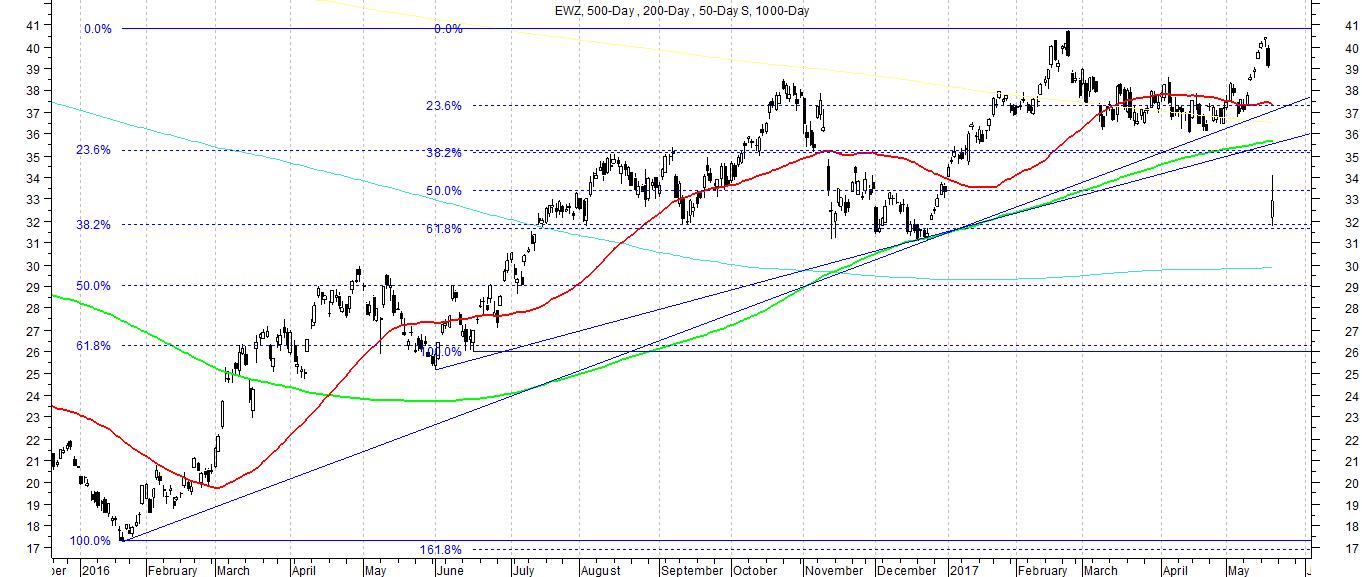

iShares Brazil ETF (EWZ):

Key Support Levels: 35.15, 31.70, 26.00

S&P Latin America Index (SPLAC):

Key Support Levels: 2944, 2723, 2370 (current date not shown on chart)

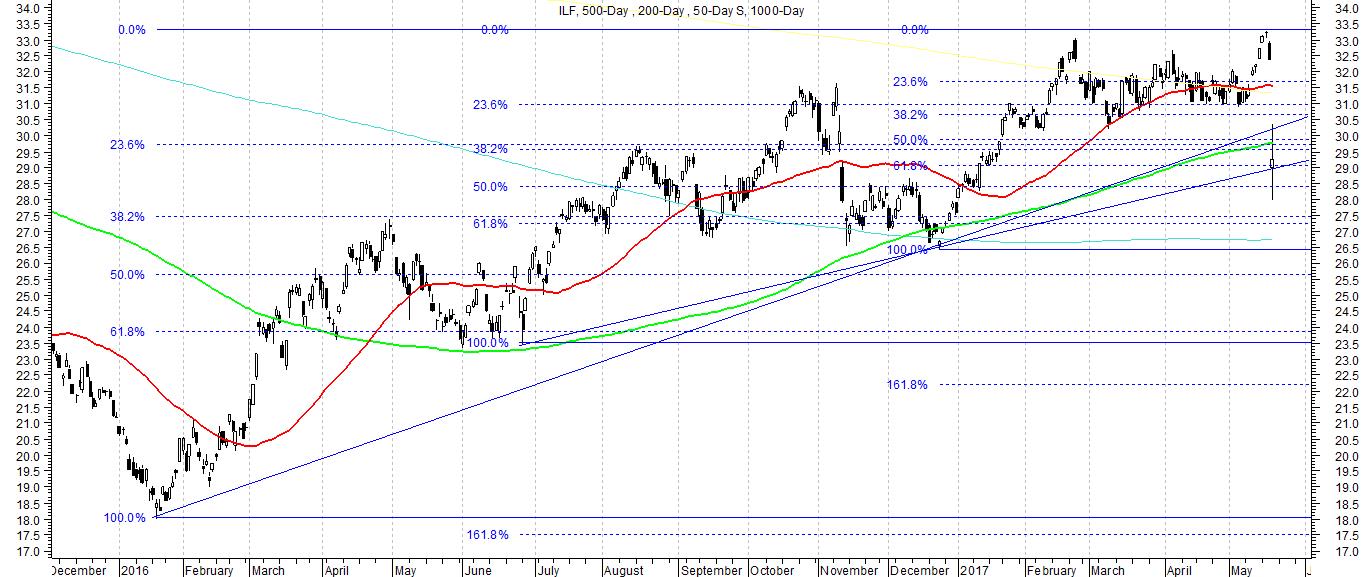

iShares Latin America ETF (ILF):

Key Support Levels: 29.50, 27.25, 23.85

_____________

Disclaimer: JLFMI’s actual investment decisions are based on our proprietary models. The conclusions based on the study in this letter may or may not be consistent with JLFMI’s actual investment posture at any given time. Additionally, the commentary provided here is for informational purposes only and should not be taken as a recommendation to invest in any specific securities or according to any specific methodologies. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.