Hunting The Vampire Squid (UNLOCKED-PREMIUM)

This post was originally published on June 7 for The Lyons Share members.

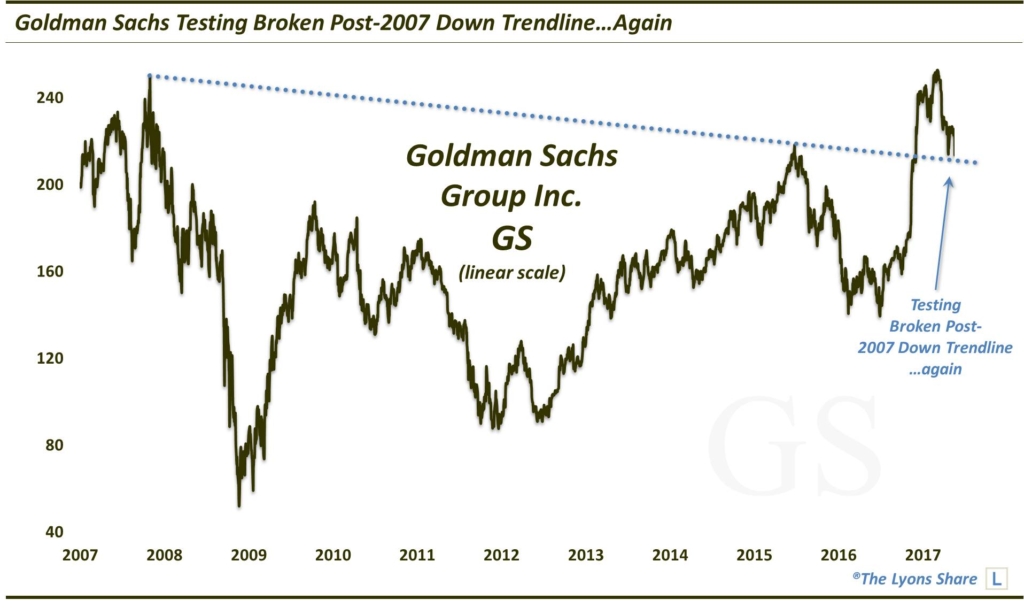

Goldman Sachs (GS) is currently testing a significant cluster of potential support.

In finance circles, investment bank Goldman Sachs (GS) has affectionately become known as the “Vampire Squid”. Now, this may be due to GS’s numerous and far-reaching tentacles throughout all-levels of business and government, its ruthless proclivity to suck money out of every conceivable corner of the business world or the difficulty in taking down or damaging the bank in any meaningful way – or likely some combination of all three.

Whatever the reason, we do know that the bank’s stock price has not escaped the recent struggles of the financial sector. But while stock bears have been piling on the recent poor performance in financials (for good reason), we are wary of adopting too negative a stance when it comes to GS. The company’s semi-bulletproof nature should always convince one to take pause when considering shorting the stock – at least, for now. Furthermore, upon inspection of its chart there is more than a good handful of solid potential support levels in the vicinity of current prices ~210.

Such levels include:

• The Post-2007 Down Trendline

• The Post-Brexit Up Trendline

• The 38.2% Fibonacci Retracement of 2016-2017 Rally

• The 61.8% Fibonacci Retracement of Post-Election Rally

• The 200-Day Simple Moving Average

• The vicinity of the 2015 former All-Time Highs

• The vicinity of the November breakout

Here is a zoomed-out picture of that post-2007 Down trendline being tested:

So, besides merely the bank’s mystique, there is plenty of ammo in the current vicinity of prices to support at least a temporary bounce. How high might a bounce carry? Since we are not bulls on the financial stocks presently, we wouldn’t hold our breadth for new highs above 255. However, GS can easily bounce to the 221 level. And if it surmounts that, it can quickly move into the mid to upper-230’s before any major roadblocks.

Again, we don’t like financial stocks in the intermediate-term. However, if there is one bank that we would typically not challenge, it is Goldman Sachs, The Vampire Squid’s reputation for survival is certainly well-known and deserved. However, as technicians, all we care about is the chart. And GS’s chart shows enough evidence of potential price support currently to be optimistic about the prospects for a decent bounce.

_____________

Disclaimer: JLFMI’s actual investment decisions are based on our proprietary models. The conclusions based on the study in this letter may or may not be consistent with JLFMI’s actual investment posture at any given time. Additionally, the commentary provided here is for informational purposes only and should not be taken as a recommendation to invest in any specific securities or according to any specific methodologies. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.