Stock Speculators Take Record Risk On Continued Calm

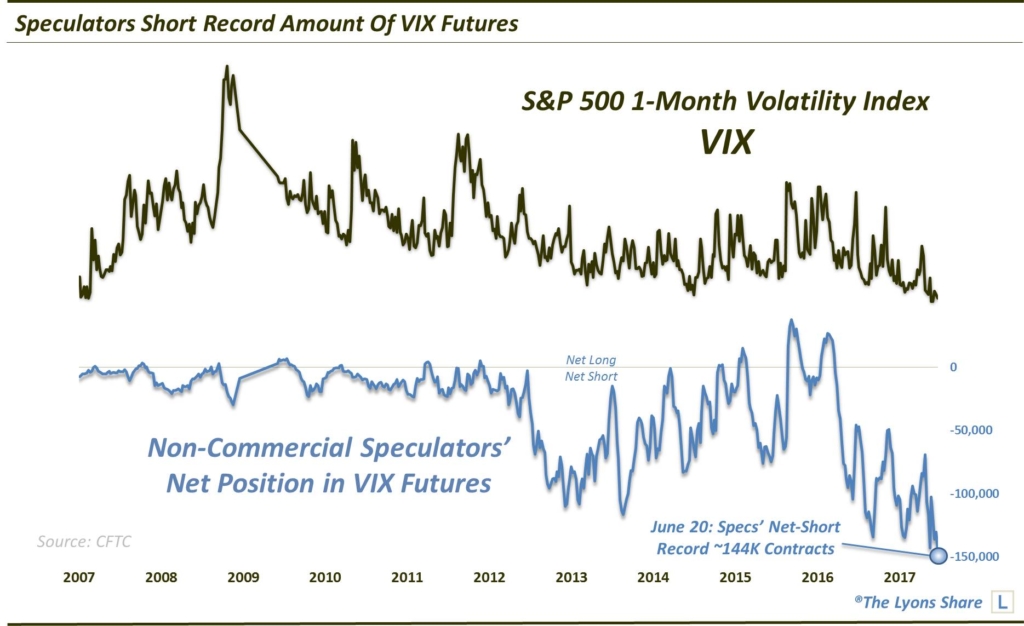

Speculators in VIX futures are presently holding their largest net-short position ever.

There’s little doubt that the current period will go down as one of the least volatile in market history. We mentioned a week ago that the Russell 2000 Small-Cap Volatility Index (RVX) had dropped to its 2nd-lowest level of all-time. Additionally, volatility expectations have recently closed near record low levels on the Nasdaq, S&P 500 and emerging market equities, as well as in other assets like gold and bonds. Well, like other markets, money flow tends to chase prices in the volatility market as well.

This is evidenced by the fact that Non-Commercial Speculators — generally trend-followers — currently hold their largest net-short position in the history of the VIX (S&P 500 Volatility Index) futures contract (via the CFTC).

Once again, futures Speculators are known as “dumb money”, not because they are always wrongly positioned — far from it. However, at positioning extremes, and at key turning points in the underlying markets, they are typically off-sides.

Presently, we cannot say that volatility is at a turning point, i.e., about to surge higher. We won’t know that until after the fact. Additionally (and, importantly), we cannot say that stock prices are about to collapse due to record low volatility levels. Volatility reached record low extremes in the mid-90′s, just prior to a historic boom in stock prices (FYI, a repeat of that occurrence is decidedly NOT our expectation).

What we can say is that Speculators are holding an extreme short position, by historical standards. Now, extremes can always get more extreme. However, history tells us that once these investors all move to one side of the boat, like the “herd” in any market, they reliably end up “in the water”, eventually.

Therefore, while the market calm may persist indefinitely, don’t expect these folks to lead you to safety before the next storm hits.

If you want the “all-access” version of our charts and research, we invite you to check out our new site, The Lyons Share.

_____________

Disclaimer: JLFMI’s actual investment decisions are based on our proprietary models. The conclusions based on the study in this letter may or may not be consistent with JLFMI’s actual investment posture at any given time. Additionally, the commentary provided here is for informational purposes only and should not be taken as a recommendation to invest in any specific securities or according to any specific methodologies. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.