Breakout Barrage – Part 1

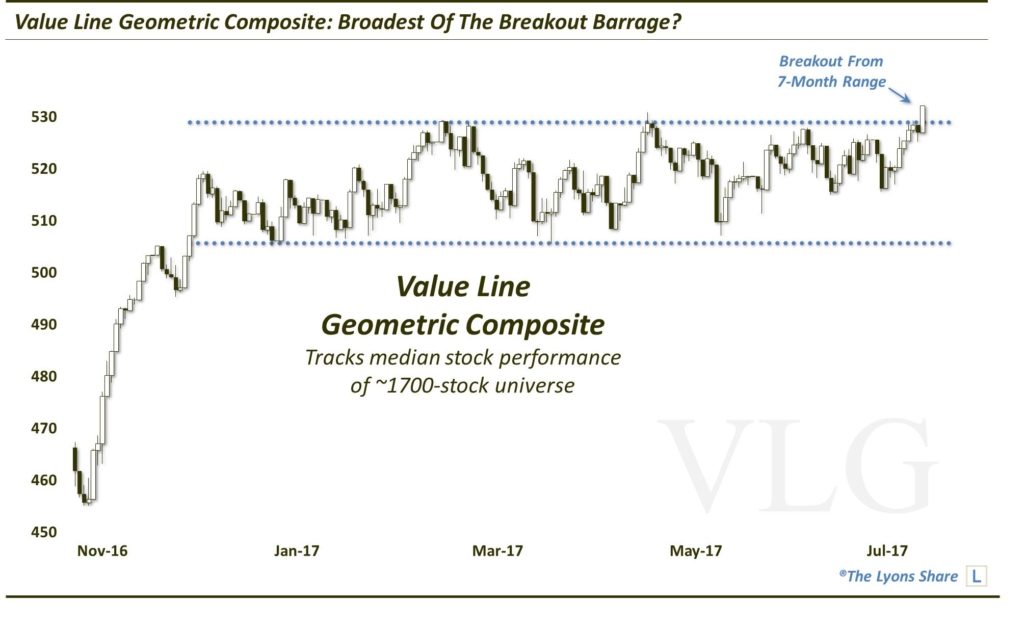

The U.S. equity market saw a wide swathe of indices break out yesterday, perhaps the broadest and most important of which was the Value Line Geometric Composite.

Yesterday’s rally on Wall Street led not only to new highs again among the popular large cap indices, but also to breakouts from extended ranges among numerous small-cap, mid-cap and broad market indices. Of the myriad of new highs, perhaps the most important, in our eyes, was that of the Value Line Geometric Composite (VLG).

As a refresher, the VLG tracks the performance of the median stock within a universe of approximately 1700 stocks. Thus, it is an extensive measure of the broad equity market and, in fact, is our favorite barometer of the health of the overall U.S. market.

Following the presidential election last fall, the VLG surged to new highs, like many indices. And like many non-large cap indices, it has been in a trading range over the 7 months since. In fact, the VLG hasn’t even scored a new marginal high since February. That is, until yesterday.

Given our view, again, of the VLG and its status as an accurate barometer of the health of the broad equity market, this breakout to new highs is a very healthy development. It doesn’t mean the market can’t become sick rather quickly. However, for now, this breakout in the Value Line Geometric Composite is probably the best medicine of all the breakouts occurring yesterday.

In Part 2 tomorrow, we’ll discuss just how many popular stock averages managed to hit new highs yesterday — and what the message behind that may be.

_____________

Disclaimer: JLFMI’s actual investment decisions are based on our proprietary models. The conclusions based on the study in this letter may or may not be consistent with JLFMI’s actual investment posture at any given time. Additionally, the commentary provided here is for informational purposes only and should not be taken as a recommendation to invest in any specific securities or according to any specific methodologies. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.

1 Comment