Not So Quick, Silver?

Along with the rest of the precious metals complex, silver has been on a nice run — but it may not be off to the races just yet.

About 7 weeks ago, as silver was careening south, we penned a note for our TLS premium members titled “A Silver (Trend-)Lining?“. The post documented a few reasons why, despite its trajectory at the time, the metal might be due for a turnaround. First off, we noted that the “smart money” Commercial Hedgers held their lowest net short position in silver futures since January 2016 when the 5-year bear market was bottoming out. That position represented a marked improvement since April when we highlighted their all-time record net short position, a likely factor in sending silver prices down some 17% to the time of our July post. The new futures positioning provided a potential tail wind for prices.

The second potentially positive factor lining up for silver was seasonality. Traditionally, silver has bottomed near the halfway mark of the year. So if history was to hold true, a turnaround was quite possibly close at hand. All that was needed was a catalyst.

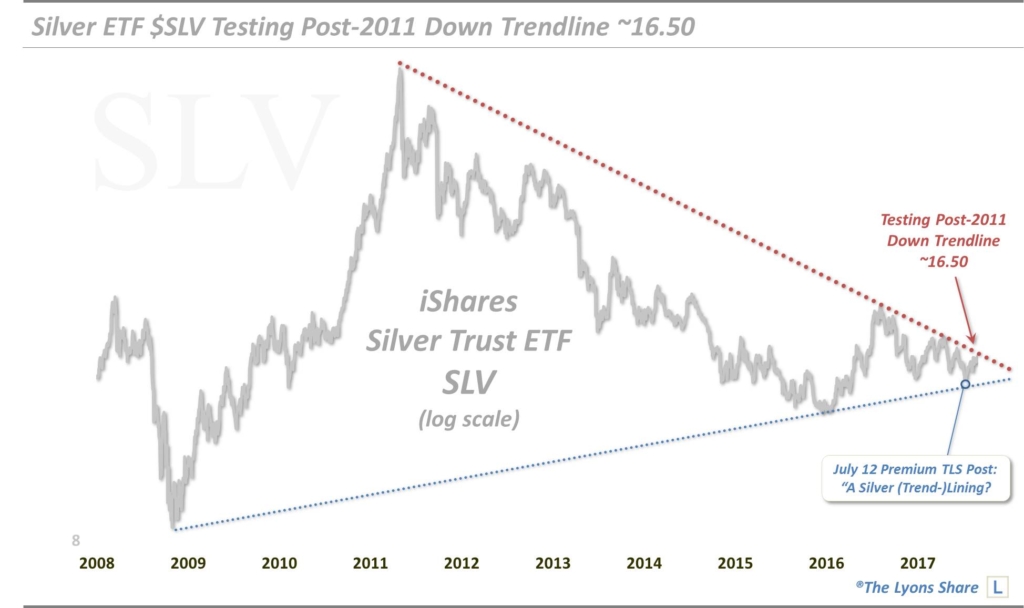

The potential catalyst that we highlighted in the July post was the lifetime Up trendline in the iShares Silver ETF (ticker, SLV). The trendline (on a log scale) began at the lows in 2008 and connected the lows in 2015-2016. At the time, the trendline was intersecting near the 14.40 level. As we noted in the post, the ETF had spiked down to 14.44 just 2 days before and rebounded strongly, sugesting that A) the trendline was valid and B) a potential reversal was indeed at hand.

The rebound has continued since, driving the SLV up nearly 15% off that July low to a close of 16.50 yesterday. The move, particularly yesterday’s strong gain, has inspired a loud chorus of precious metal optimism. That’s understandable as sentiment invariably follows prices. However, there is at least one piece of chart evidence that may temper such enthusiasm, at least in the near-term — and it is the counterpart to July’s positive catalyst.

We are talking about the lifetime Down trendline in the SLV (also on a log scale), stemming from the May 2011 all-time high and connecting peaks in August 2016 and this past April (an alternate, similar trendline can also be drawn from the secondary high in August 2011). Presently, the trendline is intersecting near the 16.50 level, right where the SLV closed yesterday.

The SLV tried to hurdle the trendline at the open today amid the excitement over North Korea. It traded as high as 16.68 before reversing and closing below the trendline, at 16.42. So, just as the Up trendline served as a positive catalyst in July, initial evidence suggests this Down trendline may have the opposite impact in repelling prices. For how long is the question.

Obviously no one has an answer for that, assuming the trendline resistance is indeed valid. We will add a few updates, however. First off, the Commercial Hedger net-short position has grown again and is not the potential tail wind that it was. However, it is squarely neutral at this point and certainly isn’t enough of a factor to worry about as far as an insurmountable head wind. Secondly, seasonality is still positive, at least through September for the metal. So that is another factor that, while perhaps not serving as the bullish factor it was in July, is not at all a negative factor at this point.

Therefore, if momentum wanted to carry the price of SLV above the Down trendline, it is certainly not out of the realm of possibility. The last observation we will make is this — given the brief time between the Up trendline touch in July and the Down trendline currently, the space between the trendlines is quickly closing. By our estimate, the 2 lines are due to converge in March of next year.

But you can bet there will be a break of this contracting pattern before then. And the direction of the break may be an indication of the direction of the next major move in silver.

If you’re interested in the premium “all-access” version of our charts and research, we invite you to check out our new site, The Lyons Share, where we are currently running our PRE-“FALL” SALE. The SALE ends September 4 so considering the discounted cost and the gathering ominous market climate, there has never been a better time to reap the benefits of our risk-managed approach. Thanks for reading!

_____________

Disclaimer: JLFMI’s actual investment decisions are based on our proprietary models. The conclusions based on the study in this letter may or may not be consistent with JLFMI’s actual investment posture at any given time. Additionally, the commentary provided here is for informational purposes only and should not be taken as a recommendation to invest in any specific securities or according to any specific methodologies. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.