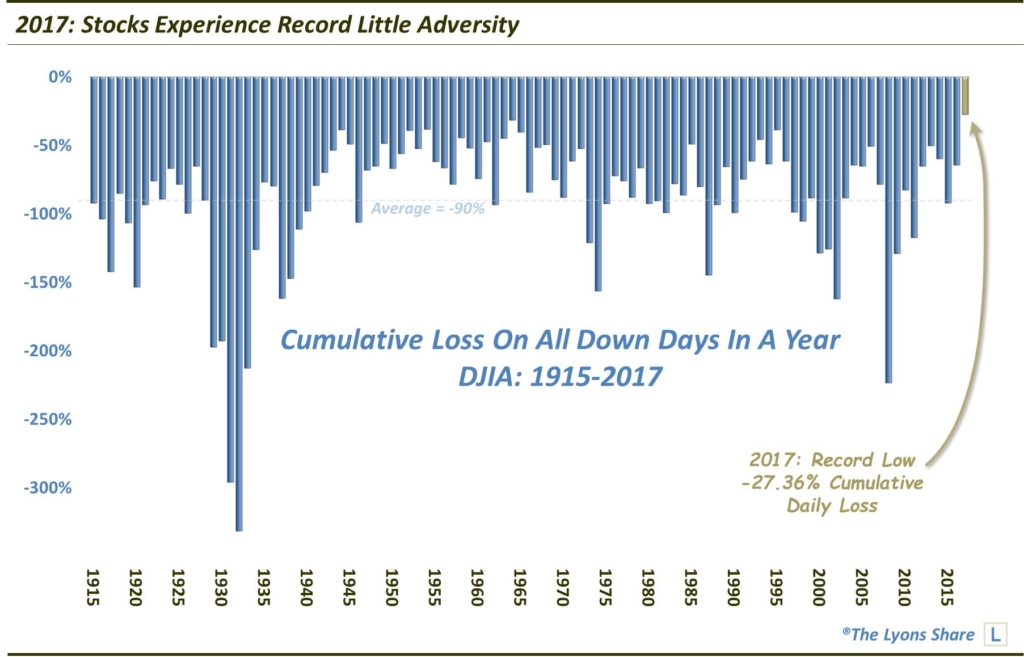

2017: Stocks Experience Record Little Adversity

Based on cumulative losses, stocks endured less adversity in 2017 than any other year on record, going back more than 100 years.

Yesterday, we pointed out that, based on the record low level of the S&P 500 Volatility Index (a.k.a., the VIX), stocks enjoyed an unprecedentedly smooth ride in 2017. Of course, that statement is based on volatility expectations, not the actual price action in the stock market. And while consistently rising stock prices are typically part and parcel of low volatility expectations, we thought we’d take a look at the actual price movement of the stock market to see if it confirmed the message given by the VIX. It did.

Accordingly, we took a look at the amount of losses incurred by the stock market during the year as a measure of adversity faced along the way to its solid full-year gains. Specifically, we tabulated the amount of losses incurred during every down day in the market. We used the Dow Jones Industrial Average (DJIA) as it has a longer history than the S&P 500. And based on these calculations, the stock market enjoyed less adversity in 2017 than any other year in history going back over 100 years (our daily DJIA data begins in 1915).

As of December 27, the DJIA had lost a cumulative -27.36% on all of its down days throughout 2017. That shattered the prior record of -31.45% set in 1965 which, by the way, is the only other year that saw less than -38% in total losses. So, other than 1965, 2017 experienced nearly 30% less adversity than any other year on record.

To add further context to this extraordinary performance, the average cumulative loss on down days during a year in the DJIA is 90%. That comes out to an average cumulative monthly loss of 7.5% — versus 2017’s average monthly loss of a mere -2.28%. To put that into perspective, historically, the DJIA averages nearly one 2% daily loss per month. That, again, is roughly equal to the entire average cumulative loss per month in 2017.

So what next — more of the same, or vicious mean-reversion? Again, to repeat the thought we offered yesterday:

“…certainly stock market bulls cannot reasonably expect the unprecedentedly smooth ride to continue forever. Volatility levels were so far below historic norms that some increase should materialize in this next year. However, there is no reason that the relative low-volatility environment cannot persist further. There is no law suggesting that an imminent spike in volatility [and associated stock losses] is likely. In fact, in our view, at this point it is more likely that the low volatility will continue in the near to intermediate-term.”

So, eventually, things will get a bit more (or a lot more) difficult for the bulls. For now, however, just enjoy the ride.

Wondering when adversity, i.e., losses, will return? Check out our “all-access” service, The Lyons Share. When we begin to see the signs of elevated risk in the stock market, TLS members will be the first to know. Also, sign up by January 1 and save 20% off an Annual Membership during our Holiday Sale. Considering the sale price — and the unlikelihood that this adversity-free investment ride can continue — there has never been a better time to reap the benefits of this service. Thanks for reading!

_____________

Disclaimer: JLFMI’s actual investment decisions are based on our proprietary models. The conclusions based on the study in this letter may or may not be consistent with JLFMI’s actual investment posture at any given time. Additionally, the commentary provided here is for informational purposes only and should not be taken as a recommendation to invest in any specific securities or according to any specific methodologies. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.

2 Comments