Silver Facing Test For Relevancy?

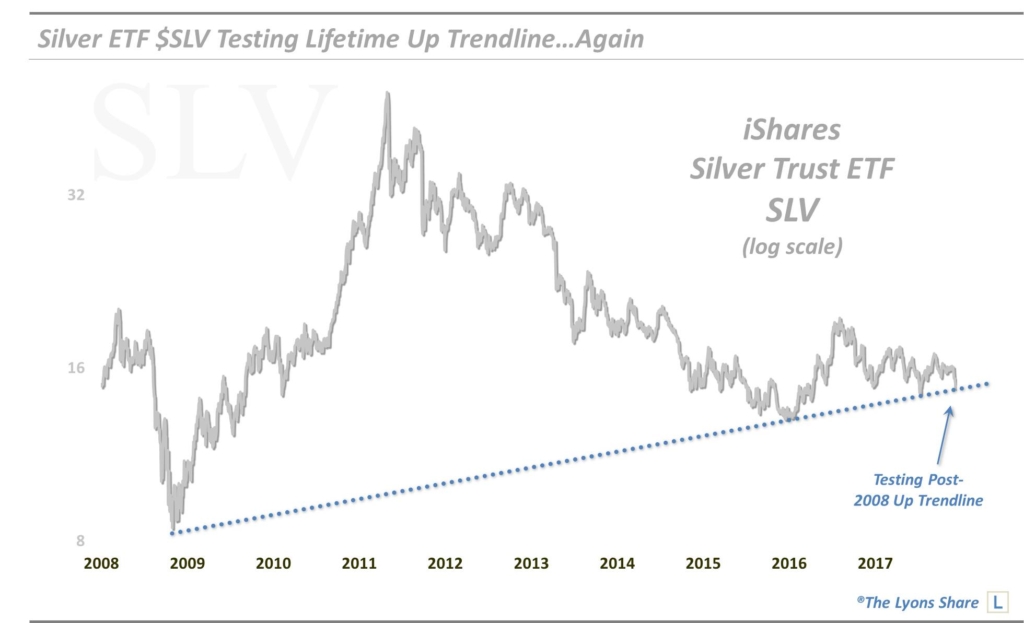

Relegated to the shadows of cryptocurrencies, Silver ETP, SLV, is facing another test of its decade-long Up trendline.

In the breathless mania (yes, mania) of the cryptocurrency phenomenon, former “alt” darlings, precious metals, have been pushed to the curb. The is especially so among a legion of anti-fiat currency folks who have fully swung their allegiance from the metals to the cryptos. Silver, in particular, is taking this breakup hard. Not only has it been dumped by former gold and silver bugs, its price has also literally been dumping. While Bitcoin and its bros have been soaring, silver is down some 10% over the past few weeks. It’s like crypto rode into town and stole silver’s girlfriend — then kicked sand in its face on the way out.

But silver may have an opportunity right now to thrust itself back into relevancy. That’s because it is presently testing an important price support level that may potentially serve as a catalyst for a rebound of some magnitude — at least in the iShares Silver ETP (ticker, SLV). This past July, we highlighted the fact that the SLV, in the midst of a steep selloff at the time, was testing potential support in the form of its lifetime Up trendline stemming from its 2008 low and connecting the late 2015 low.

The trendline test would prove successful as the SLV immediately rallied on its way to a 20% gain over the subsequent 2 months. Since early September, however, it has been a rough ride for the metal. The SLV has now proceeded to give up nearly its entire post-July gain. The saving grace, as mentioned, is that the SLV is once again testing that post-2008 Up trendline, currently near the 14.74 level.

So will this Lone Ranger ride in and save silver once again? (see what I did there?). Time will tell, but the trendline certainly has cemented itself as relevant at this point, especially after July’s immediate bounce. The thing we don’t particularly like is the fact that the SLV is already testing the trendline again, as the more frequent the test, the more likely the trendline is to break.

In the near-term, however, it is a good bet that the trendline produces at least a dead-cat bounce. Indeed, today was a good start as the SLV spiked as much as 3% off of the trendline (FYI, lest one think this is Monday-morning quarterbacking, we posted this chart as part of our #TrendlineWednesday feature around noon CST when the SLV was only up a few pennies. Furthermore, we have been highlighting this potential trendline event to TLS members over the past few days in our Daily Strategy Videos). As long as the trendline does hold, silver’s got a shot to at least compete for some “alt” dollars. If the trendline breaks, the metal may as well go on sabbatical until crypto-mania burns out.

If you’re interested in the “all-access” — and timely — version of our charts and research, please check out our new site, The Lyons Share. Considering what we believe will be a very difficult investment climate for perhaps years to come, there has never been a better time to reap the benefits of our risk-managed approach. Thanks for reading!

_____________

Disclaimer: JLFMI’s actual investment decisions are based on our proprietary models. The conclusions based on the study in this letter may or may not be consistent with JLFMI’s actual investment posture at any given time. Additionally, the commentary provided here is for informational purposes only and should not be taken as a recommendation to invest in any specific securities or according to any specific methodologies. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.