Norwegian Stock Market Cruises To New Highs

While global equity markets continue to chop around, Norway is hitting new all-time highs.

Members of The Lyons Share know that like to scour the globe in search of opportunities. That can be an important tactic, especially when U.S. stocks are stuck in a trendless, range-bound market…at best. As we have emphasized for awhile now in our Daily Strategy videos for TLS members, there are a handful of countries that we’ve identified in our regular scan of global markets that have weathered the recent correction very well. And some, in fact, are even back to new post-January highs. One such country is Norway.

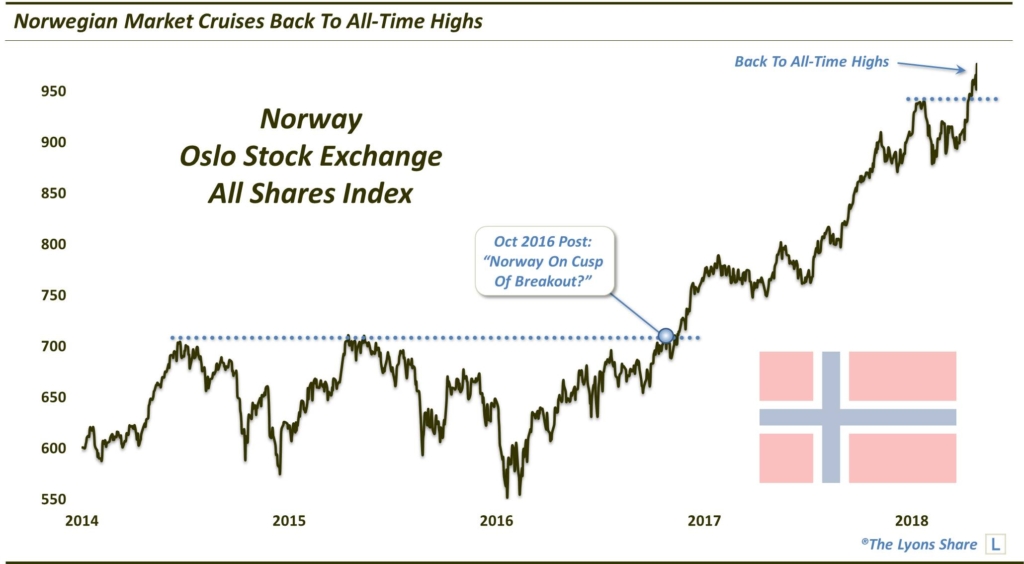

The last time we blogged about Norway was in October 2016. At the time, its benchmark Oslo Stock Exchange All Shares Index (OSEAX) was testing its former all-time high peaks, near the 700 level, set in 2014 and 2015. While some were nervous about a potential triple top, which did snakebite the OSEAX back in 2007, we surmised that the index would eventually be successful in moving to new highs. Indeed it was successful, in short order, and by early 2018, the index would reach up near the 950 level, some 35% higher.

Now, as mentioned, after weathering the recent correction very well, the OSEAX is back into new all-time high territory.

Will this breakout lead to a significant new up-leg? That remains to be seen. There is potential Fibonacci Extension resistance just above, near 1000, which could slow down the nascent ascent. However, considering the alternatives in the U.S. and around the world, the price structure (i.e., higher highs and NEW highs) in the Norwegian market is certainly more constructive than most other markets.

How would one take advantage of this opportunity? As we’ve been telling TLS members, there are a number of Norwegian ETF’s here in the U.S., including the iShares MSCI Norway ETF (ENOR), the Global X MSCI Norway ETF (NORW) and the Global X FTSE Nordic Region ETF (GXF). The first 2 especially have demonstrated good relative strength of late, along with the success of the local Norway market. That said, as we must warn every time we talk about international equity funds, there is a substantial currency effect on the movement of the ETF’s as well. Specifically, if the U.S. Dollar continues its recent bounce, it will act as a headwind for further appreciation in these Norwegian funds.

If you’d like assistance in identifying favorable international markets and other “out of the box” opportunities, we publish RS rankings of the 1000 most liquid ETF’s every week for members of The Lyons Share. Or if you’re interested in the “all-access” version of our charts and research, check out TLS. You can follow our investment process and posture every day, including insights into what we’re looking to buy and sell and when. Thanks for reading!

_____________

Disclaimer: JLFMI’s actual investment decisions are based on our proprietary models. The conclusions based on the study in this letter may or may not be consistent with JLFMI’s actual investment posture at any given time. Additionally, the commentary provided here is for informational purposes only and should not be taken as a recommendation to invest in any specific securities or according to any specific methodologies. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.