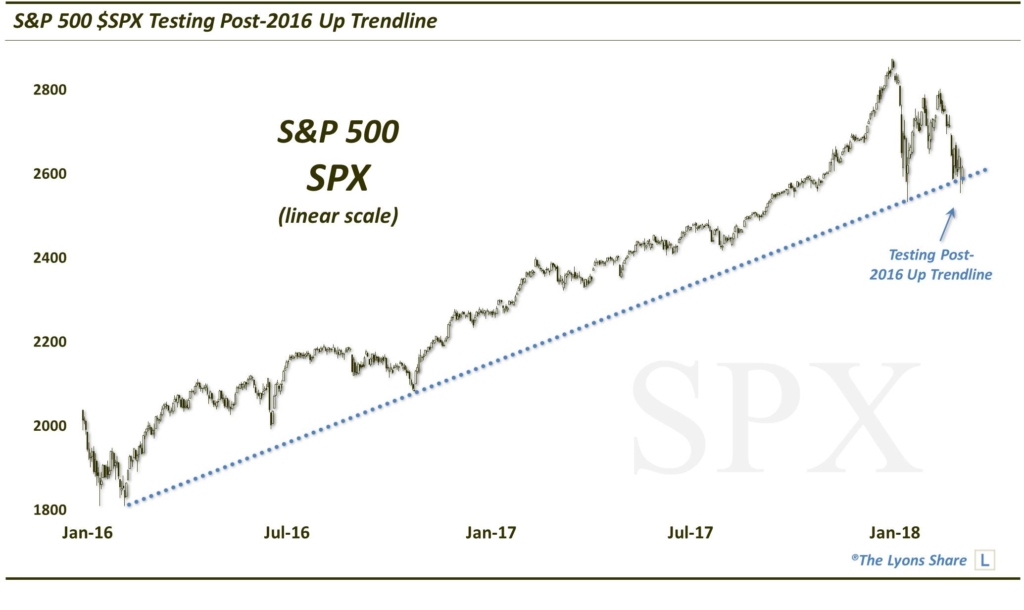

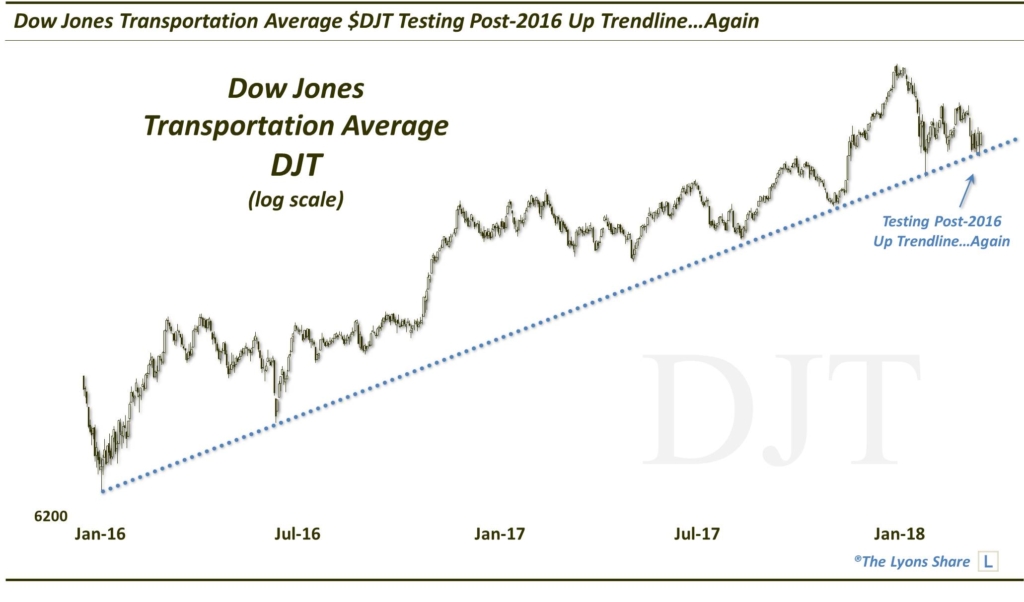

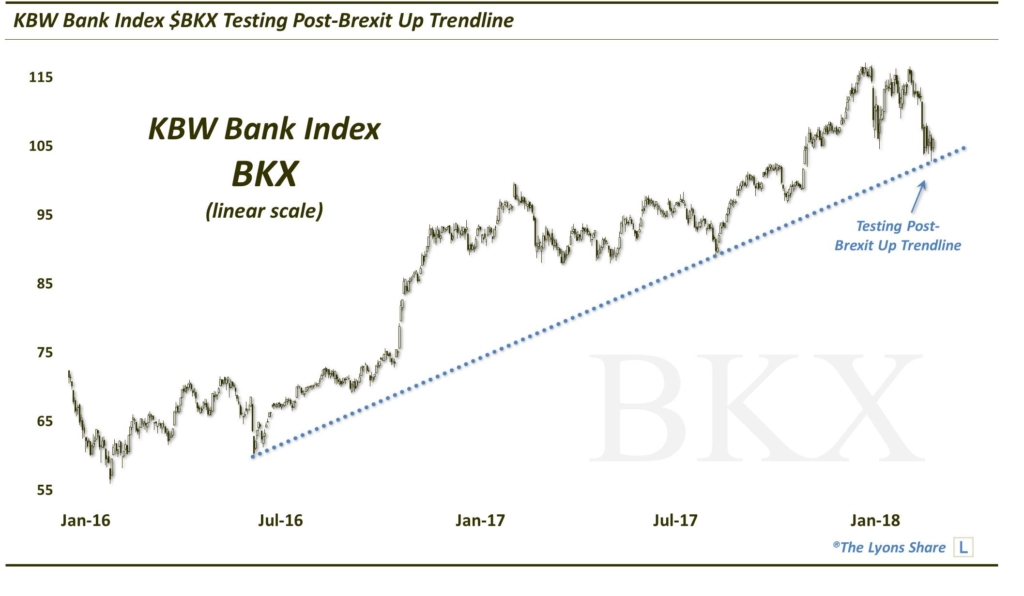

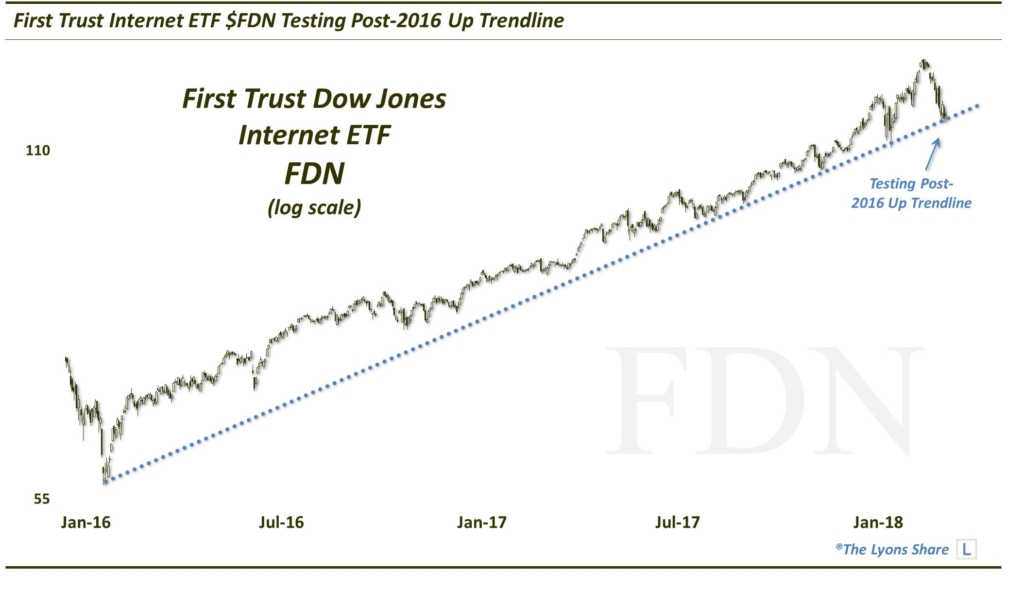

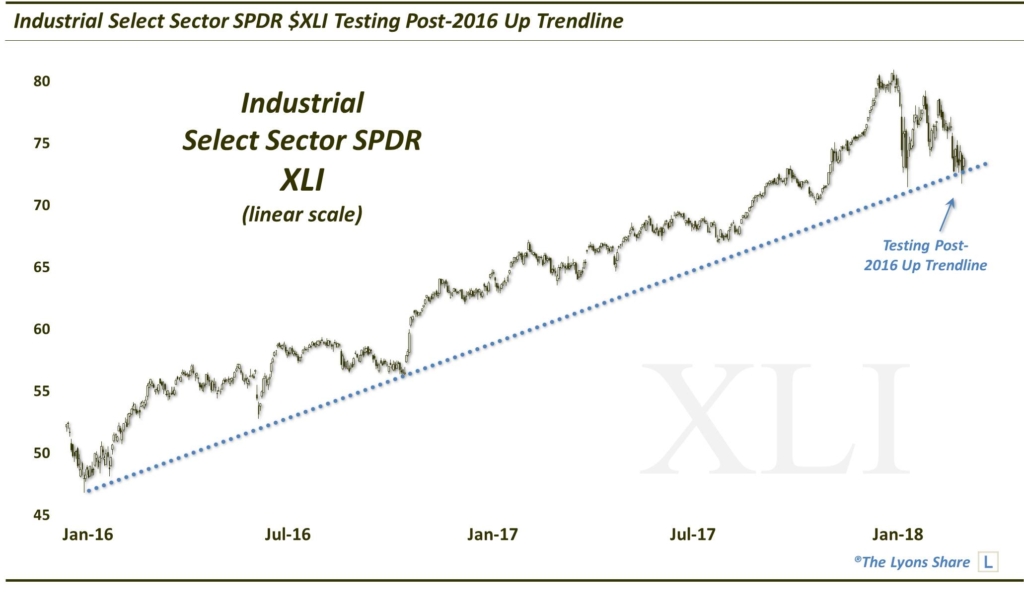

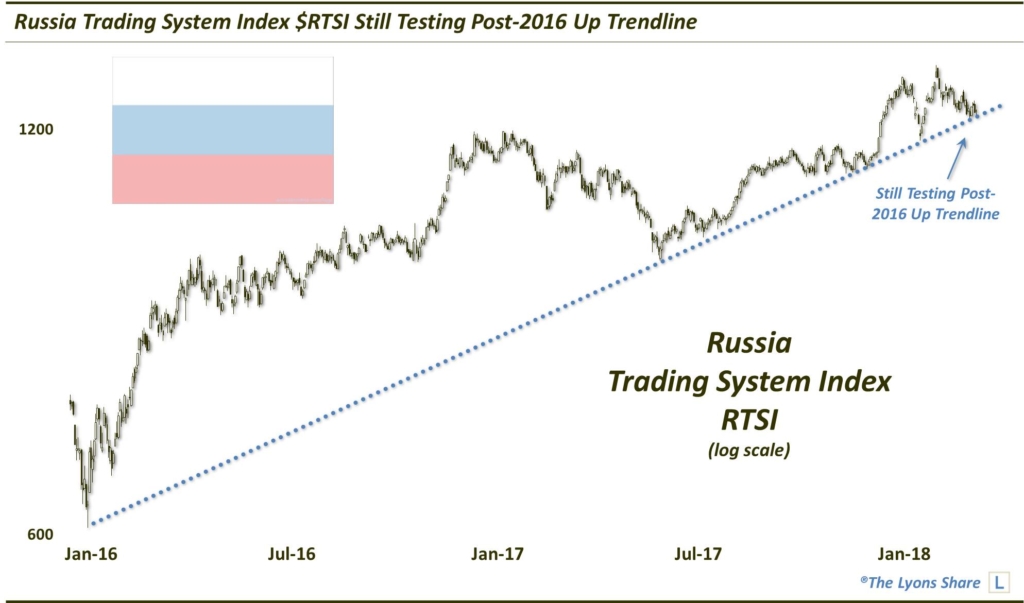

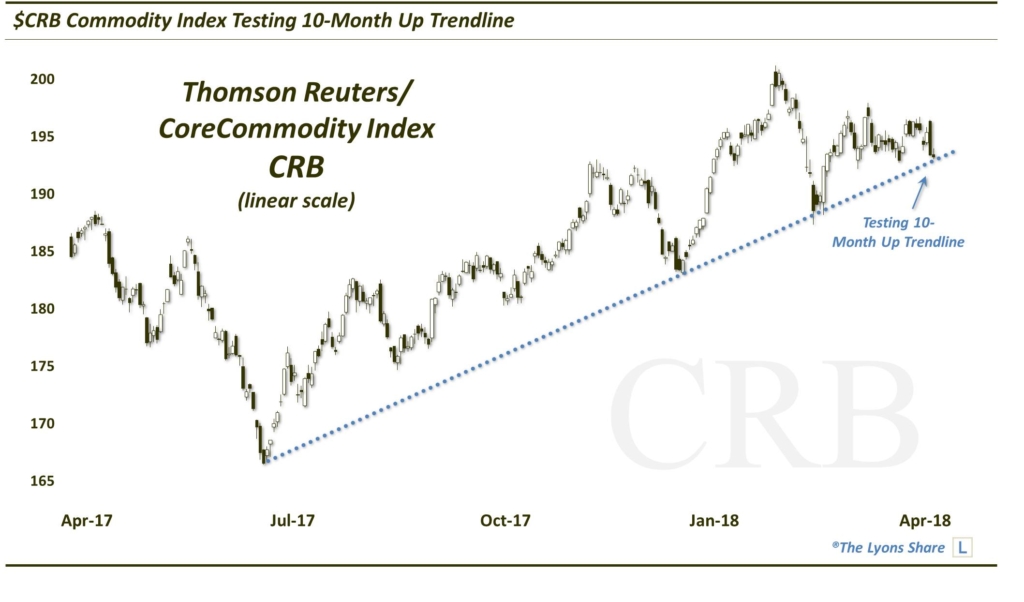

Stock Uptrends Bend But Don’t Break (Yet)

After a choppy week, key bull market trendlines are still being tested in many stock indices.

A week ago, we dedicated a blog post to the trendline developments that we posted in our weekly #TrendlineWednesday feature on Twitter. The reason for the unusual post was because of the prolific number of key trendlines being tested at the time in a wide array of indices and stocks. Well, after a volatile week that basically saw the market make little headway, up or down, there has been scant resolution among these trendline tests. Therefore, our #TrendlineWednesday feature is just as prolific as last week’s.

Here are this week’s relevant trendlines that we highlighted (among many other worthy candidates):

Will these trendlines continue to hold? Only time will tell. In our experience, the more times a trendline is tested, and the more frequently it is tested, the more likely it is to break. However, the proof is in the prices and until proven otherwise, it’s all bend but no break at this point.

If you’re interested in the “all-access” version of our charts and research, please check out our new site, The Lyons Share. You can follow our investment process and posture every day — including insights into what we’re looking to buy and sell and when. Thanks for reading!

_____________

Disclaimer: JLFMI’s actual investment decisions are based on our proprietary models. The conclusions based on the study in this letter may or may not be consistent with JLFMI’s actual investment posture at any given time. Additionally, the commentary provided here is for informational purposes only and should not be taken as a recommendation to invest in any specific securities or according to any specific methodologies. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.