Shanghai Express Ready To Run Again?

This is a FREE look at the macro analysis and trade setups that we provide every day for members of The Lyons Share.

China’s battered Shanghai Composite may find support at nearby prices.

Following the global equity rout of 2015-2016, China’s Shanghai Composite (SSEC) rebounded along with the rest of the world markets. There was one difference with the SSEC, however, as we saw it. While other markets had a bead on their pre-rout highs, the SSEC was still well below its bubbly top set in mid-2015. Therefore, at some point we expected the SSEC to run into formidable resistance and fade from the global market rally. Indeed, we saw that unfold earlier this year – and from precisely where we suggested it would.

In our Daily Strategy Session video for members of The Lyons Share back on January 24 of this year, one of the 3 themes we discussed was “Exiting SHANGHAI Express?”. At the time, while the SSEC was on a roll (up 7.5% ytd already), we felt it was time for the aforementioned resistance to kick in. Approaching 3600, the index was in the vicinity of the 38.2% Fibonacci Retracement of the 2015-2016 bear market as well as the late-2015 bounce highs. The SSEC would literally peak that very day (January 24).

While we felt the going would get tougher for the SSEC from there, we didn’t know how tough it would get. As it turns out, it would be an extremely brutal 6 months. After rallying some 35% since its early-2016 lows, the Shanghai Composite proceeded to lose the entire gain as of the past month.

As the chart indicates, the SSEC first hit its nearby lows around 2700 about a month ago. After a reflexive bounce, the index is re-testing those lows again presently. Furthermore, as we mentioned, the SSEC is not only finding potential short-term support at last month’s lows, it is also testing the vicinity of its January-March 2016 lows. Those 3.5-year lows may provide further impetus for at least a short to intermediate-term bounce in the SSEC.

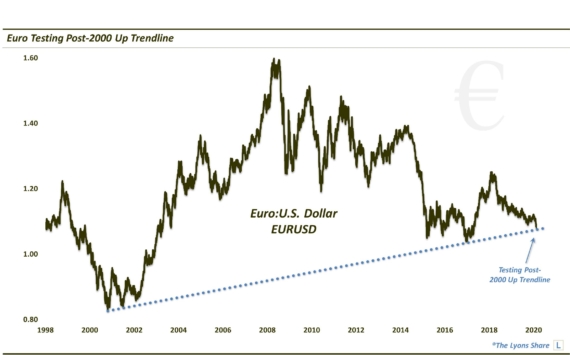

But that’s not all. If we scroll back, as in 2 decades, we find even more evidence of potential support — specifically, in the form of the post-1996 Up trendline connecting the lows from 2005 and 2013-2014.

The U.S. equity market has been chugging along since its mini correction earlier in the year. As it approaches its former highs, however, some are wondering if it will have enough energy left for a breakout and a meaningful new advance. Well, if the Shanghai Express, er, Composite is ready to finally leave the station again, perhaps that will provide some fuel for a new leg up.

If you’re interested in the “all-access” version of our charts and research, please check out our new site, The Lyons Share. You can follow our investment process and posture every day — including insights into what we’re looking to buy and sell and when. Thanks for reading!

_____________

Disclaimer: JLFMI’s actual investment decisions are based on our proprietary models. The conclusions based on the study in this letter may or may not be consistent with JLFMI’s actual investment posture at any given time. Additionally, the commentary provided here is for informational purposes only and should not be taken as a recommendation to invest in any specific securities or according to any specific methodologies. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.