(Trend-)Setting The Stage For Market Fireworks?

More major global equity indices have joined the ranks of those testing key bull market trendlines.

Last week, we highlighted the plethora of major stock market indices that were testing (breaking?) key uptrend lines across the European region. As this week’s edition of #TrendlineWednesday on Twitter points out, the “trend” of important global equity indices undergoing key trendline tests has expanded. And one of the more significant trendline tests that we have observed across the globe can be found in China.

As we pointed out to premium members of The Lyons Share a month ago, not only is the benchmark Chinese Shanghai Composite (SSEC) testing its lows from early 2016, it is also testing an Up trendline that is more than 2 decades old.

As the chart shows, the SSEC is testing its post-1996 Up trendline which connects its lows from 2005 and 2013-2014. We don’t want to over-emphasize the influence of the SSEC, and this trendline, on the fate of the global equity market. However, there is no question that a further meltdown could have adverse effects on global equities, particularly emerging markets.

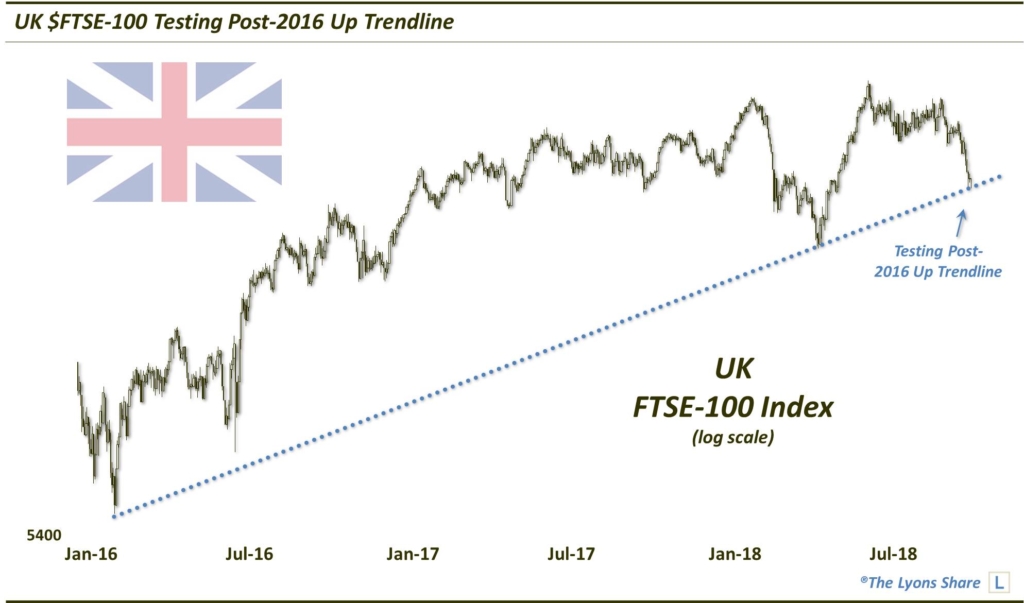

Re-visiting the European region, we find yet another major index testing a bull market Up trendline. In the case, the UK’s FTSE-100 is testing its post-2016 Up trendline.

Will the FTSE suffer the same fate as its European counterparts — or does its technical structure offer a different outcome? That is to be determined. However, like the Shanghai Composite, the outcome could cause ripples — or fireworks — across the global equity landscape.

At The Lyons Share, we comb the charting globe every day for our members to unearth these important trendlines and technical developments. Not only that, we lay out ways to take advantage of these potential opportunities as well. If you’re interested in the “all-access” version of our charts and research, please check out our new site, The Lyons Share. You can follow our investment process and posture every day — including insights into what we’re looking to buy and sell and when. Thanks for reading!

_____________

Disclaimer: JLFMI’s actual investment decisions are based on our proprietary models. The conclusions based on the study in this letter may or may not be consistent with JLFMI’s actual investment posture at any given time. Additionally, the commentary provided here is for informational purposes only and should not be taken as a recommendation to invest in any specific securities or according to any specific methodologies. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.