Finally Some Support To Bank On? (PREMIUM-UNLOCKED)

The following post was originally issued to The Lyons Share members on October 25, 2018.

This level in the bank stocks may hold the key in stabilizing the current selloff.

Yesterday demonstrated again why JLFMI president John Lyons always says, “in a correction, support is just a 7-letter word.” Indeed, just about every stock index, sector, etc. broke what looked to be solid support levels yesterday. Such breaks opened the way to the next key support levels lower (it’s also another good reminder of the importance of stop-losses). One key sector, however, may already be hitting that “next support level.” That would be the banks.

Why are the banks key (outside of the generic context typically applied to the sector by tv “gurus”)? One reason is because the sector has been one of the main drivers of the recent portion of the correction. So if the sector can find some solid support, it may provide some further stabilization to the overall market in general. And one bit of potentially good news is that while most areas of the market have opened up further potential downside, the benchmark KBW Bank Index (BKX) has reached what we identified as potential support.

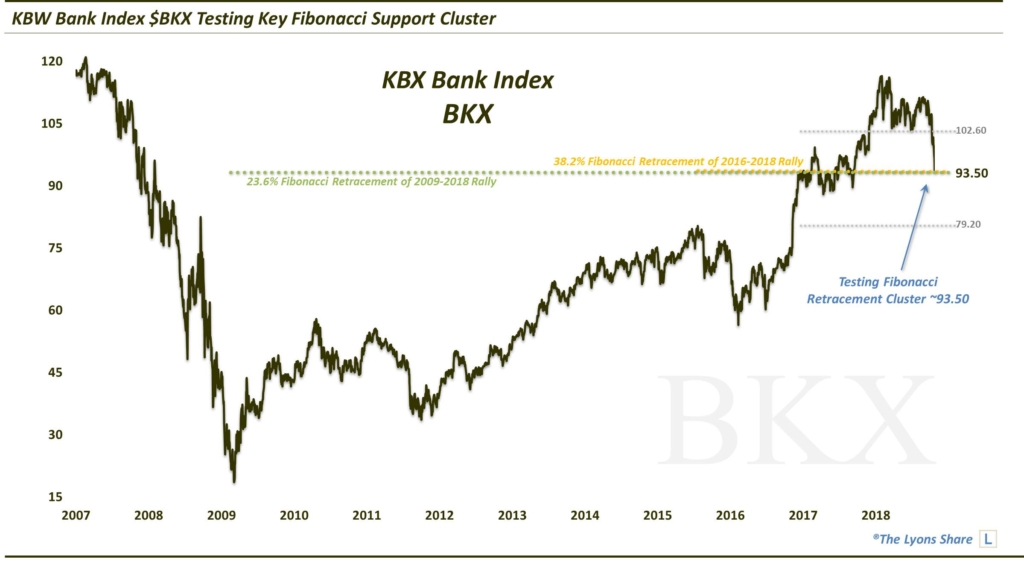

On Tuesday’s and Wednesday’s DSS videos, we mentioned the 93.50 level as potential support in the BKX due to the following key Fibonacci support:

- The 23.6% Fibonacci Retracement of the 2009-2018 Rally

- The 38.2% Fibonacci Retracement of the 2016-2018 Rally

Sure enough, the BKX bottomed at 93.65 yesterday.

Now, this doesn’t guarantee that this wave of selling is over and that the initial low is in (though, today’s 2%+ gain in the index is pretty good validation of the level). But it is one significant downside target that has now been achieved. We have no real interest in buying the banks there, necessarily, as it remains one of our least favorite sectors. However, if it does hold this line in the sand, it may serve as a key bit of support, even if we see other sectors and indices breach their recent lows.

For reference, the upside support level had been 102.60 and, if 93.50 is broken, the next major level to watch is 79.20.

If you’re interested in the “all-access” version of our charts and research, we invite you to check out our site, The Lyons Share. FYI, given the current treachorous market landscape, TLS has extended our CRASH SALE through this weekend. So considering the discounted cost and the current treacherous market climate, there has never been a better time to reap the benefits of our risk-managed approach. Thanks for reading!

_____________

Disclaimer: JLFMI’s actual investment decisions are based on our proprietary models. The conclusions based on the study in this letter may or may not be consistent with JLFMI’s actual investment posture at any given time. Additionally, the commentary provided here is for informational purposes only and should not be taken as a recommendation to invest in any specific securities or according to any specific methodologies. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.