Just Your “Average” Pullback?

The “average” stock in the market may be breaking key uptrend support.

Although, barely a week into the current equity selloff, there has already been a lot of speculation about whether this is a healthy pullback or a more serious correction. From a large-cap standpoint, the argument seems rather silly considering the indices are still mere percentage points off of their all-time highs. For the broader market, however, it may already be appropriate to be having such discussions. And that’s significant to us as our investment philosophy is predicated on being aligned with the trend of the overall market.

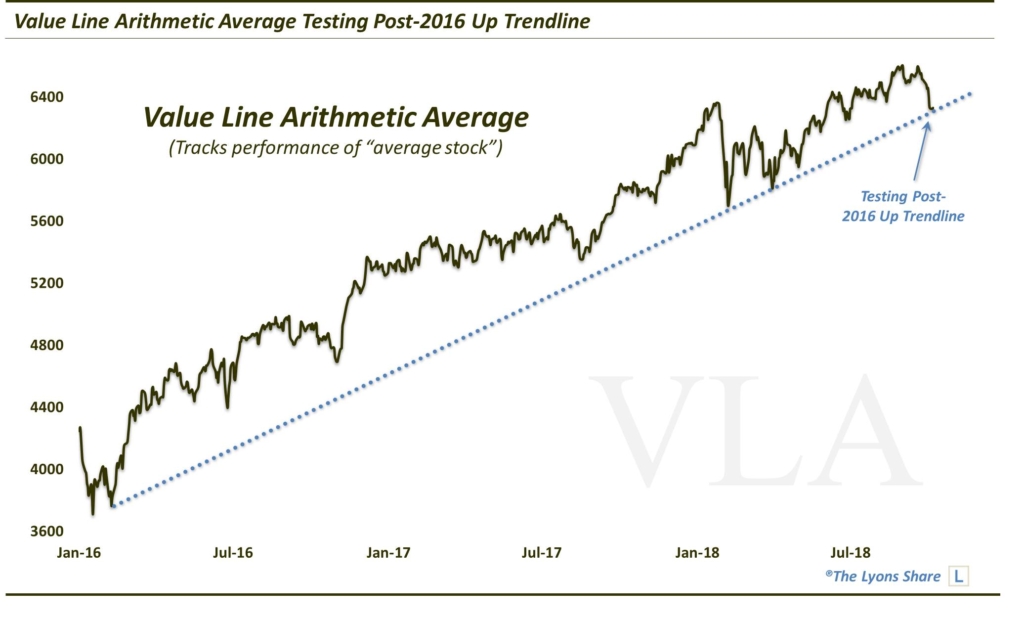

Now, there are many different ways to view and assess the “overall” market. One way is to look at an index called the “Value Line Arithmetic Index” (VLA). The VLA measures the performance of the “average” stock in a universe of about 1800 stocks. Thus, it arguably presents a reasonable picture of the position and trend of the overall market. And if indeed that is true, then the overall market is at an interesting juncture in its ongoing bull market.

We say that because the VLA is presently testing the Up trendline stemming from its 2016 low.

Actually, the chart is through yesterday’s close (10/9). Thus, today’s weakness may very well be signifying a breakdown in this uptrend. And while that may not equate to a death knell of the cyclical bull market, it may very well open the path to further lows in the near-term.

This is not the only key market or security testing (or breaking) a major trendline at the moment. Check out our Twitter stream to see some of the other significant trendline developments that we highlighted in our weekly #TrendlineWednesday feature.

And if you’re wondering how concerned we are (or aren’t) about these developments, please check out our new site, The Lyons Share. Members of The Lyons Share know our thoughts as they have an “all-access” pass to our charts and research…and can follow our investment process and posture every day — including insights into what we’re looking to buy and sell and when. Thanks for reading!

_____________

Disclaimer: JLFMI’s actual investment decisions are based on our proprietary models. The conclusions based on the study in this letter may or may not be consistent with JLFMI’s actual investment posture at any given time. Additionally, the commentary provided here is for informational purposes only and should not be taken as a recommendation to invest in any specific securities or according to any specific methodologies. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.