Finding Marginal Utility Still In The Stock Rally (UNLOCKED-PREMIUM)

Utility stocks may be setting the stage for the next phase of their rally.

When it comes to investment selection, we espouse the relative strength philosophy. That is, we believe in concentrating portfolios in the strongest performing areas of the market. That said, when it comes to entry points, we prefer to buy the high relative strength into near-term pullbacks as opposed to chasing runaway stocks (recent action in semiconductor stocks shows why). We just prefer to align the risk/reward prospects in our favor as much as possible. One area that has presented a potentially attractive setup on all accounts this week has been the utility sector.

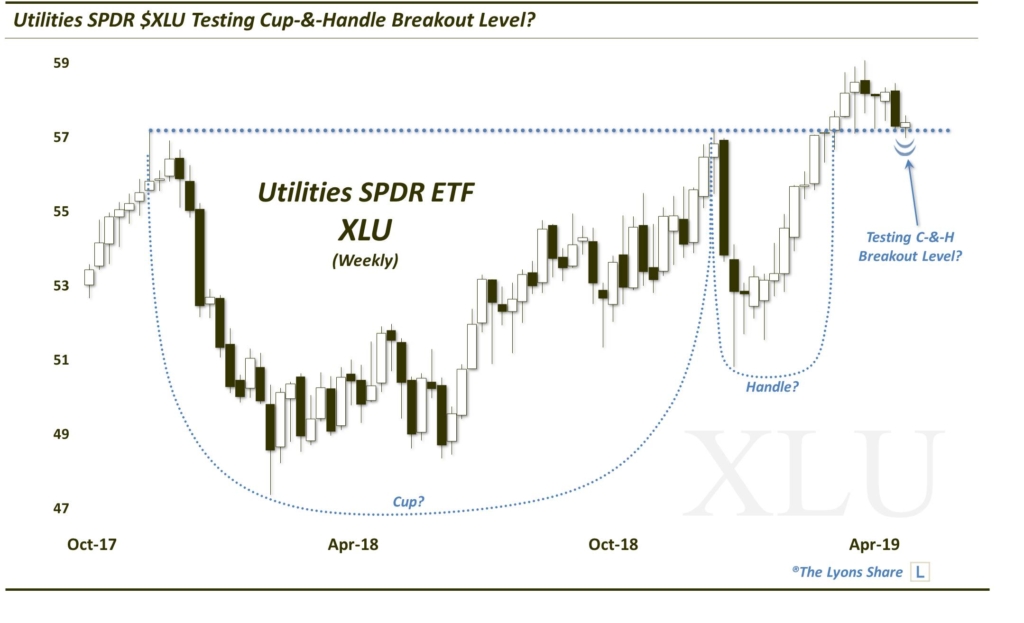

Utility stocks were a clear relative strength leader in the 1st quarter, especially considering their high dividend and low volatility characteristics. The Utilities Select Sector SPDR (ticker, XLU), for example, was up roughly 15% for the quarter. The fund also arguably completed a 16-month bullish “cup-&-handle” chart formation, breaking out to new all-time highs near $57 in early March.

Over the past month, the fund has undergone a not unhealthy phase of consolidation of that breakout. With longer-term relative strength still intact, we have been laying out to TLS members the possibility of a test of the $57 breakout level and potential attractive entry point into the XLU. Over the past few days, that scenario has played out with the fund bottoming at 56.98 on April 23 before bouncing.

At this point the fund is up about 3% off of that breakout test. Should it be a successful test and lead to a sustainable next phase of its rally, there should be considerable further upside based on the potential cup-&-handle. Of course, the fund is not out of the woods by any means. A loss of $57 may not signal the end of the XLU’s rally — but it should usher in some additional selling pressure down to at least $56 or $55.

However, at this point it has been a textbook entry point into a longer-term relative strength leader.

If you are interested in an “all-access” pass to our research and investment moves like these every day, we invite you to further check out The Lyons Share. Given a potentially emerging treacherous market climate, there has never been a better time to reap the benefits of our risk-managed approach. Thanks for reading!

_____________

Disclaimer: JLFMI’s actual investment decisions are based on our proprietary models. The conclusions based on the study in this letter may or may not be consistent with JLFMI’s actual investment posture at any given time. Additionally, the commentary provided here is for informational purposes only and should not be taken as a recommendation to invest in any specific securities or according to any specific methodologies. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.