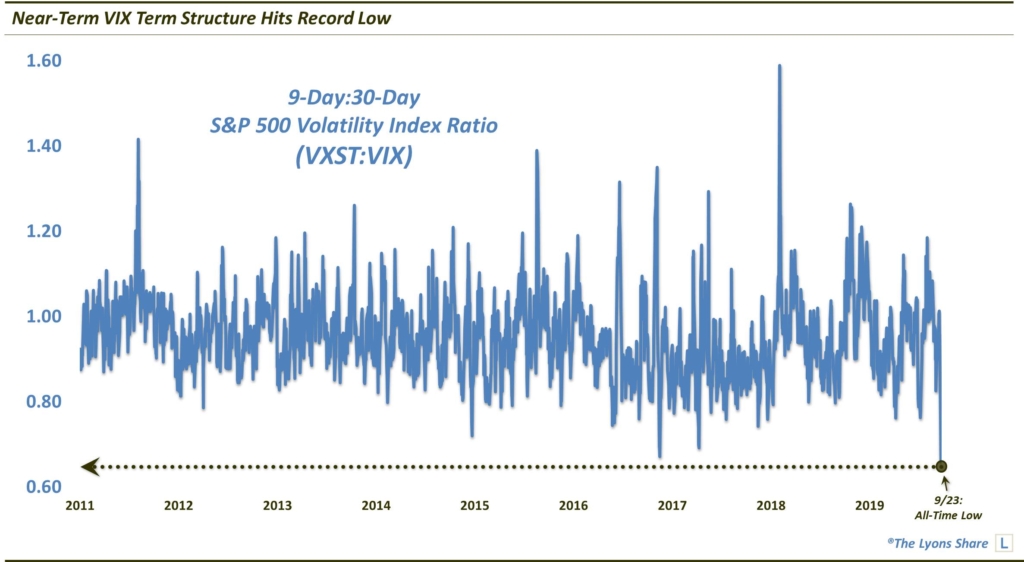

Have Stock Investors Gotten Too Complacent?

Near-term volatility expectations just dropped to a record low relative to those further out.

One effective way of measuring sentiment in the stock market is by using the volatility market, specifically the “term structure”. As we’ve mentioned in the past, “term structure” compares near-term expectations versus those further out.

For example, let’s compare the 9-day S&P 500 Volatility Index, VXST, versus the 1-month index, VIX. Typically, the VXST will be lower than the VIX as there is less time in the near-term for volatility rises to occur. However, when investors get especially nervous, the near-term VXST can at times temporarily rise above the VIX. Conversely, when investors get especially complacent, the near-term VXST may drop to an extremely low level relative to the VIX.

Historically, roughly the .80 level has been considered a low extreme for the VXST:VIX ratio. Since the inception of the VXST in 2011, there have been 2 instances where the ratio dropped below .70. Actually, as of yesterday, September 23, make that 3 instances. And in fact, as our Chart Of The Day reveals, at a reading of 0.659, yesterday saw the lowest reading in the history of the ratio.

So have stock investors become too complacent? Or are these volatility traders on to something regarding a lack of concern (it wouldn’t be the first time they were correct in the near-term)? Or is there perhaps a structural reason for this historically skewed reading? While we certainly cannot know the answer for sure, we did take a historical look at this development in today’s TLS subscriber video and will continue to monitor this development.

If you’re interested in the “all-access” version of our charts and research, please check out our site, The Lyons Share. You can follow our investment process and posture every day — including insights into what we’re looking to buy and sell and when. FYI, our analysis suggests that several markets are on the cusp of major long-term junctures so it’s a great time to sign up! Thanks for reading!

_____________

Disclaimer: JLFMI’s actual investment decisions are based on our proprietary models. The conclusions based on the study in this letter may or may not be consistent with JLFMI’s actual investment posture at any given time. Additionally, the commentary provided here is for informational purposes only and should not be taken as a recommendation to invest in any specific securities or according to any specific methodologies. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.