High Low Friday – 2/28/2020

Here are some of the most noteworthy new highs and lows across the markets for Friday, February 28, 2020.

These are but a few of the highs and lows resulting from a truly historic week in the markets.

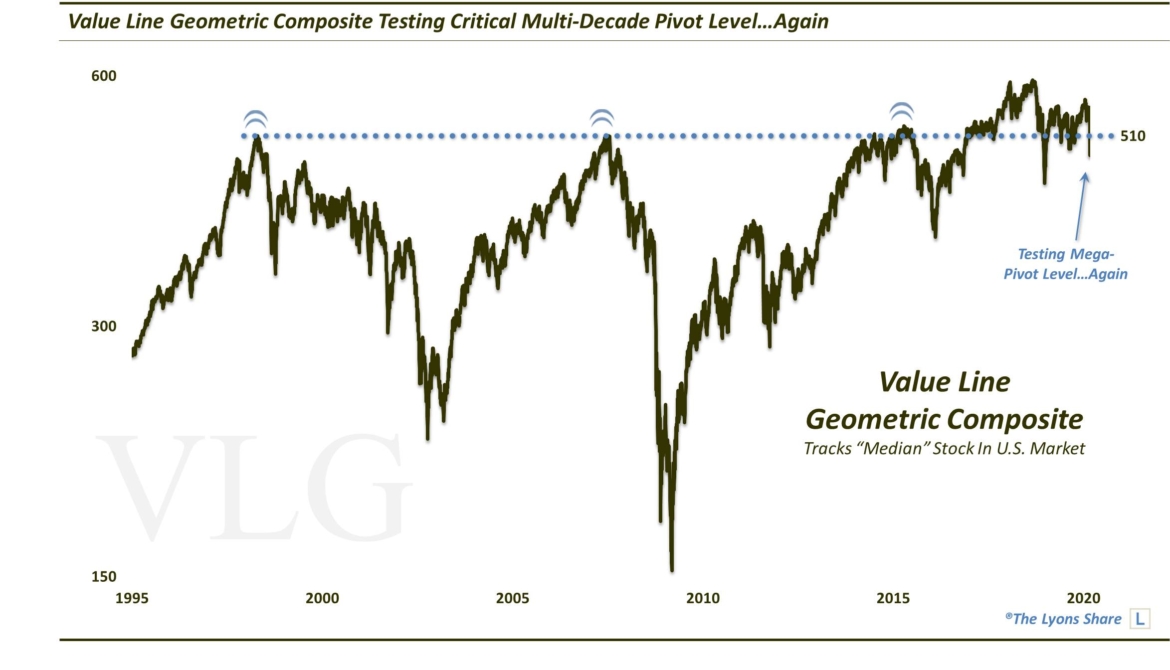

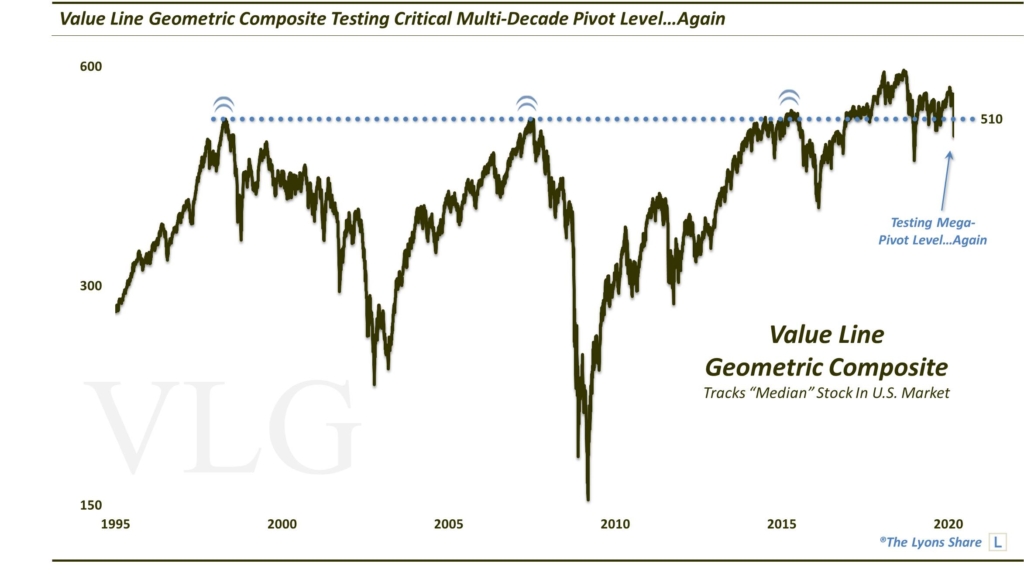

The most important index, the Value Line Geometric Composite, is testing the most important line in the equity market…again. Will the breakout level of the former multi-decade triple highs hold — or will it be a massive false breakout? $VLG $VALUG

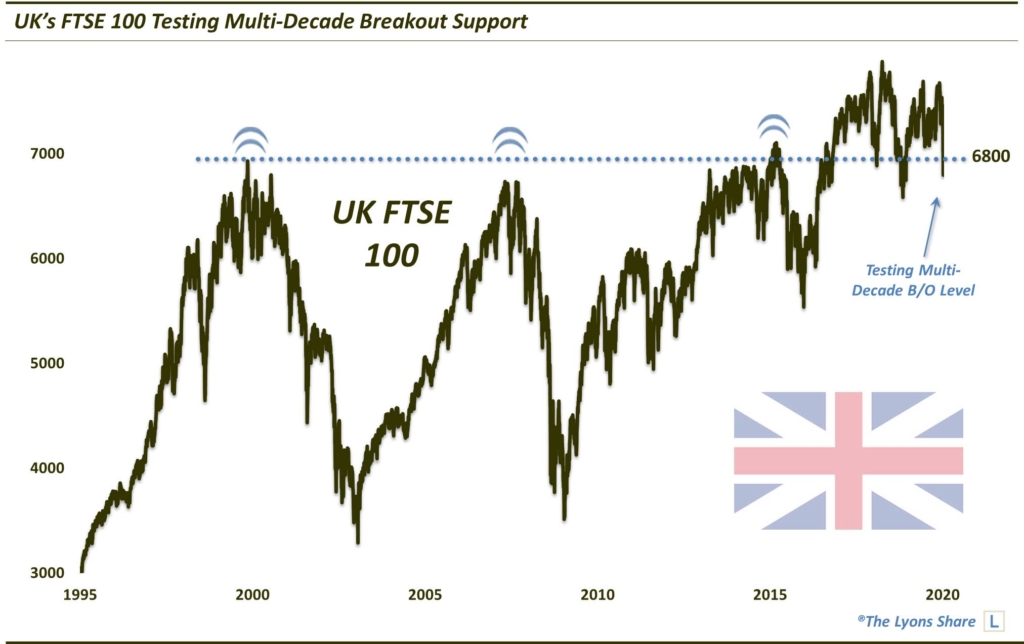

Similarly, UK’s $FTSE is testing the breakout level of its former highs spanning multiple decades.

The rush into bonds pushed the 10-Year U.S. Treasury Yield $TNX to all-time lows.

Fear abounds as the 1-month:3-month S&P 500 Volatility Index Ratio ($VIX:$VXV) moved to its highest reading ever outside of the financial crisis.

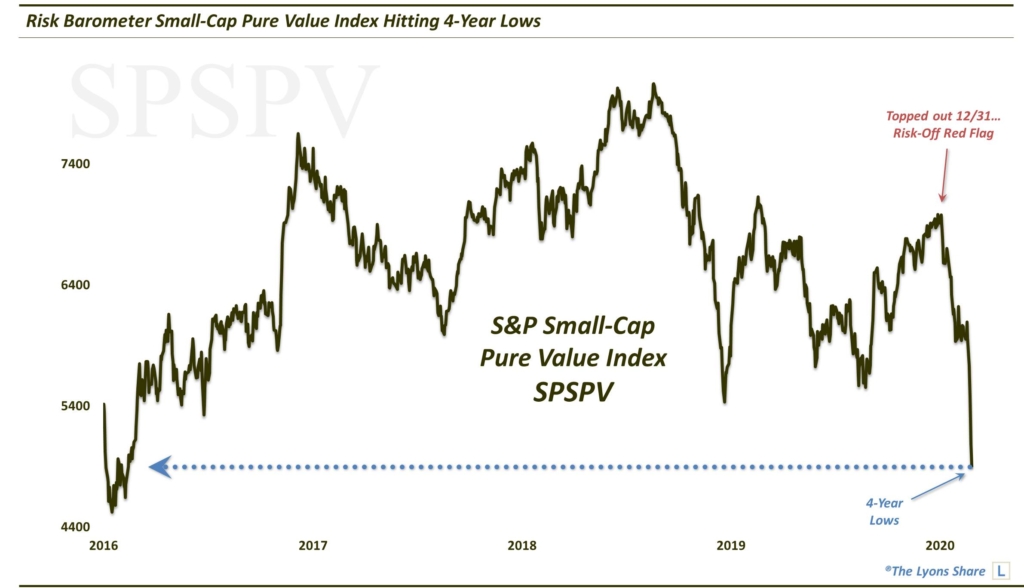

Lastly, an index that we use as a Risk Barometer on the market, the S&P Small-Cap Pure Value Index $SPSPV, has fallen to 4-year lows. It also topped out on December 31, creating a striking divergence that allowed us to reduce our investment risk in recent weeks.

If you’d like to see these charts as they come out in real-time, follow us on Twitter and StockTwits. And if you’re interested in the daily “all-access” version of all our charts and research, please check out our site, The Lyons Share. You can follow our investment process and posture every day — including insights into what we’re looking to buy and sell and when. We are also holding a Launch Anniversary Sale with prices set at the ORIGINAL 33% 40% OFF LAUNCH RATE! So it’s a perfect time to join! Thanks for reading!

_____________

Disclaimer: JLFMI’s actual investment decisions are based on our proprietary models. The conclusions based on the study in this letter may or may not be consistent with JLFMI’s actual investment posture at any given time. Additionally, the commentary provided here is for informational purposes only and should not be taken as a recommendation to invest in any specific securities or according to any specific methodologies. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.