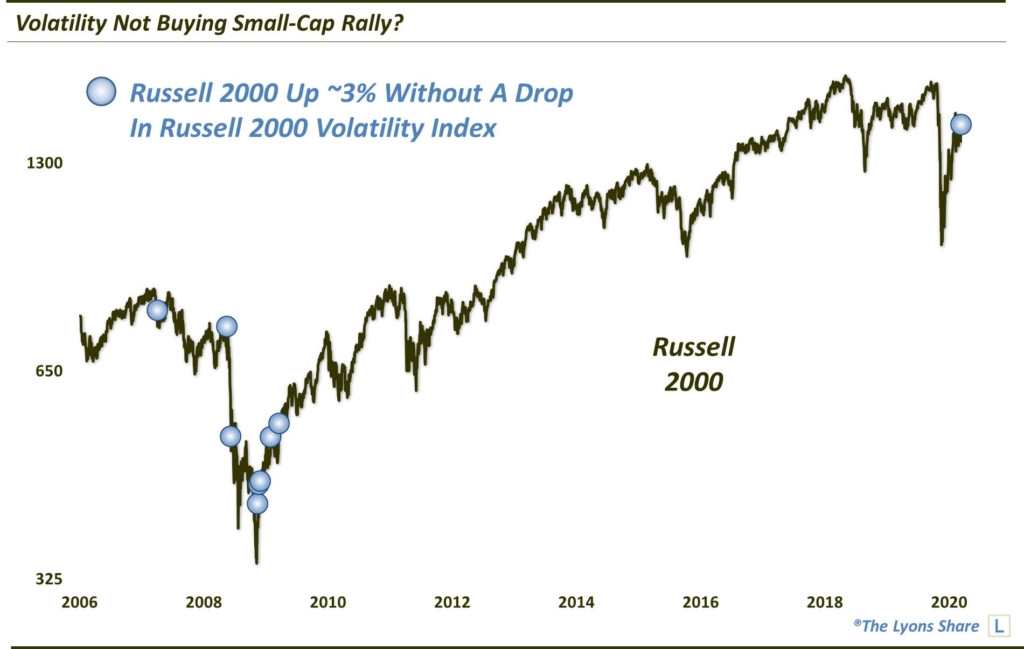

Volatility Not Buying Small-Cap Rally?

Despite the big small-cap rally yesterday, the volatility market didn’t budge.

After holding key support levels in prior days, the recent market laggards scored big gains yesterday. This includes the Russell 2000 Small-Cap Index (RUT) which jumped some 3.5%. However, despite the big rally, the Russell 2000 Volatility Index (RVX) refused to budge (it was down .02). Normally such a rise in the stock index would see a sizable decline in volatility expectations. In fact, of the 104 days that saw the RUT rise roughly 3% or more since 2006, the RVX has averaged a decline of more than -7%. Furthermore, before yesterday, just 7 of those days saw the RVX close higher or essentially unchanged — none in the past decade.

So, what is this data point telling us? Is the volatility market “smarter” than the equity market? And, thus, is this a warning of the potential unsustainability of the small-cap bounce? There is anecdotal, if not statistically significant evidence to support an affirmative answer to both those questions. We do observe similar incidents in August 2007 and September 2008 that preceded massive market declines. On the other hand, the last several occurrences took place in the aftermath of the March 2009 market low which simply led to a further extension of the equity rally.

So, the jury is out on this 1-day phenomenon. We will say, however, that the refusal of the volatility market, in general, to break below key support levels should be a concern for stock market bulls. Until that support gives way, it may keep a lid on stock prices.

How much “stock” are we putting into this data point? How is it impacting out investment posture? If you’re interested in an “all-access” pass to all of our charts, research — and investment moves — please check out our site, The Lyons Share. You can follow our investment process and posture every day — including insights into what we’re looking to buy and sell and when. Thanks for reading!

_____________

Disclaimer: JLFMI’s actual investment decisions are based on our proprietary models. The conclusions based on the study in this letter may or may not be consistent with JLFMI’s actual investment posture at any given time. Additionally, the commentary provided here is for informational purposes only and should not be taken as a recommendation to invest in any specific securities or according to any specific methodologies. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.

1 Comment