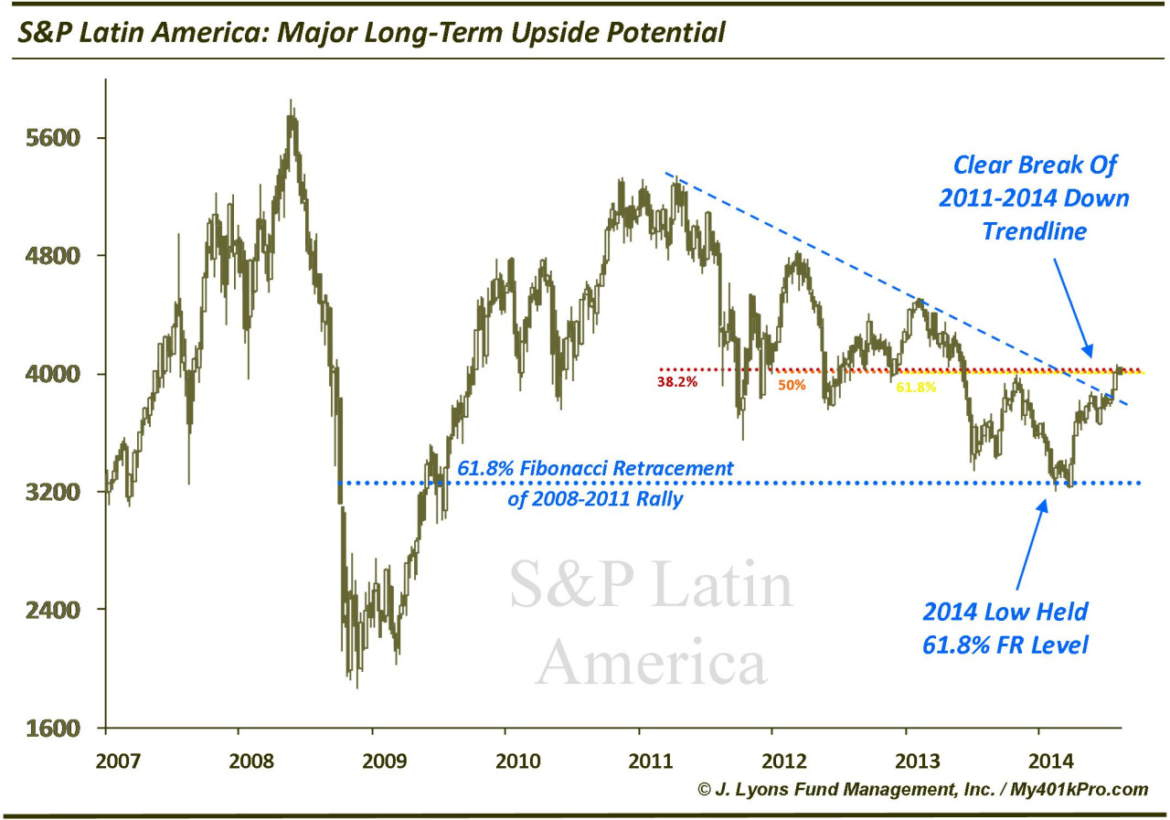

Regional Spotlight: Major Upside Potential In Latin America

At times, investors get too caught up in micro-analyzing intraday price moves or reacting to noisy daily news events. Sometimes all one needs are a few big data points to hone in on a market’s key message. So it is, we believe, with Latin American stocks, as represented by the S&P Latin America Index (we have mentioned the possible bottoming process in the S&P Latin America Index on several occasions, including April 3 and May 6.)

The 2 big points in this case are:

- The 61.8% Fibonacci Retracement of the 2008-2011 rally held when tested in January-March of this year. A major level like this can not only arrest a decline, but a successful hold can boost confidence and attract money flows.

- The index clearly and decisively broke the down trendline from 2011 to 2014. This is evidence of a trend change on top of support holding in the first point.

Latin America stocks are still quite possibly in a secular (long-term) bull market that started in 2002. If true, there is substantial upside potential still, back to the highs and well beyond perhaps. Identifying an attractive entry point is the key. The 2 big points listed above, on the heels of a 3-year bear market (i.e., very oversold conditions) certainly make the case that the attractive entry point is here.

Currently, the S&P Latin America Index is at a perfect cluster of Fibonacci Retracement resistance lines, pursuant to tops in 2011 (38.2%), 2012 (50%) and 2013 (61.8%). This may temporarily slow down this advance. However, if the points above are valid, the eventual upside could be substantial.