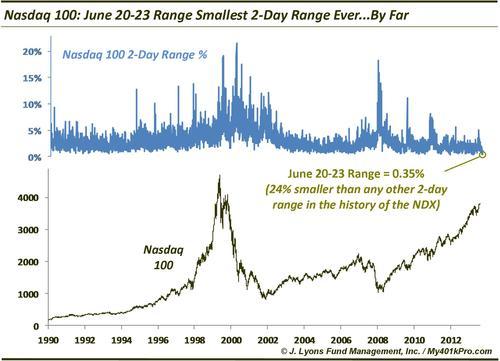

ChOTD-6/24/14 Nasdaq 100: June 20-23 Range Smallest 2-Day Range Ever…By Far

Well, it took all of 24 hours to break our pledge not to post any more on the current low volatility market environment (though, we are not surprised). Some of the developments are just too noteworthy not to mention, however, such as today’s ChOTD: the range in the Nasdaq 100 the past two days is THE smallest in the history of the index (to 1990).

The range from June 20-23 was a minuscule 0.35%. Not only is this a record, it is 24% smaller than the previous low of 0.46% from September 2012. This study, by the way, includes end-of-year holiday trading. Additionally for you technicians, the previous 2 days qualify as double-inside days. We’ll see if that compression leads to an explosive move (half a percent qualifies in this market?)

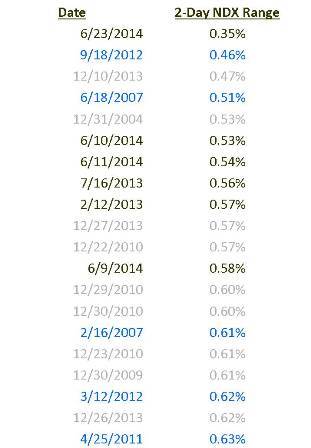

Digging into the history of the smallest 2-day ranges yields some interesting observations, lest one think this is merely an useless bit of trivia. Here is a table of the 20 smallest 2-day ranges in NDX history:

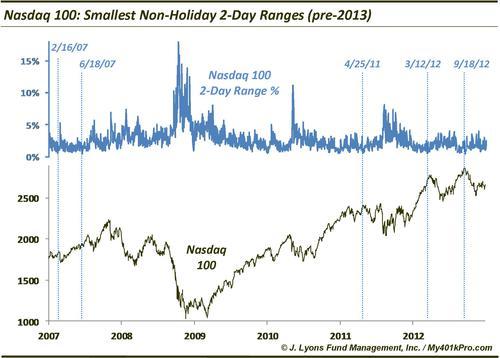

We have grayed-out 9 of the results that occurred during end-of-year holiday trading (though, the 12/10/2013 may not qualify). Of the remaining 11, 6 of them occurred during the current post-2012 rally. The remaining 5 in blue (shown on the following chart) are interesting:

The 5 all occurred between 2007 and 2012. Like the present case, each of them occurred while the index was at a 52-week high. They also all preceded short to intermediate-term tops within 1 day to 1 month.

- 2/16/07: NDX formed short-term top 3 days later, dropping 7% following 8 days

- 6/18/07: NDX formed intermediate-term top 1 month later, dropping 14% following 1 month (final cyclical top came 2.5 months later)

- 4/25/11: NDX formed intermediate-term top 3 days later, dropping 8% following 6 weeks and 15% following 4 months

- 3/12/12: NDX formed intermediate-term top 3 weeks later, dropping 13% following 2 months

- 9/18/12: NDX formed intermediate-term top 1 day later, dropping 13% following 2 months

In a normal environment, we would consider the current small range while at a 52-week high to be a red flag. Who knows when a “normal” environment will return, however.