ChOTD-4/24/14 Cyclically Adjusted Price Earnings Ratio (CAPE) @ Secular Bear Market Extremes

An excerpt from our May Newsletter “2014 Secular, Ahem, Bear Market Update”:

Valuation

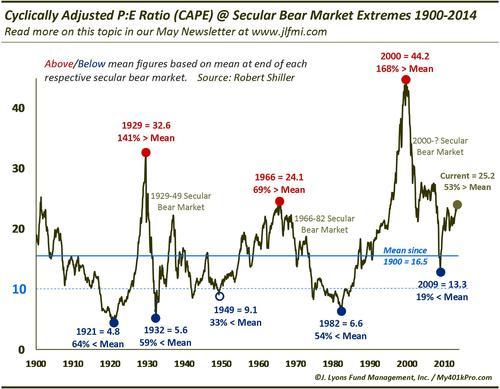

Like prices, all matters of ancillary metrics related to the stock market reach an extreme at the end of a secular bull market that must be met with an equal reaction in the opposite direction during the subsequent secular bear. This includes valuations, i.e., how expensive the market is relative to the underlying stocks’ fundamentals. Valuations, such as the ratio of price to earnings, get pushed to extremely expensive levels during euphoric secular bull tops and reach relatively cheap extremes at the end of secular bears. As we have in the past, we will use the cyclically-adjusted price to earnings ratio (CAPE) as an example. The CAPE method averages earnings over a ten year period in order to smooth out temporary dislocations in fundamentals such as occurred during the financial crisis in 2009.

After reaching an extreme in valuation at secular bull tops in the early 1900’s, 1929 and 1966, CAPE reacted in an equal and opposite way during the course of each respective ensuing bear market. In 1929, the CAPE ratio reached 141% above its long-term mean. Subsequently, it dropped to 59% below the mean by 1932. The secular bull top in 1966 was accompanied by a CAPE reading 69% above the mean, followed by a secular bear low in 1982 at 54% below the mean. The current cycle saw the CAPE reach an all-time high of 44.2, or 168% above the long-term mean, in 2000. A move to that extreme would beg a move to an eventual extreme in the opposite direction. Yet, the low CAPE in the secular bear market since, registered in 2009, was just 19% below the mean. That is hardly an equal and opposite reaction to all-time high valuations.

Furthermore, on an absolute basis, by the end of each secular bear market in 1921, 1949 and 1982, the CAPE ratio had fallen to single digits. The current cycle low in 2009 only hit 13.3. We should expect that to fall significantly lower based on historical standards before a sustainable secular bull market is launched. Incidentally, the current CAPE reading of 25.2 is at or above levels reached at the top of the secular bull markets in 1966 and the early 1900’s. That is somewhat alarming, especially given the abundance of voices telling us that the market is not expensive.

As an aside, some people make the case that 2009 valuations were low enough to mark the end of the secular bear, particularly given that valuations bottomed in 1932, well before the end of the 1929-49 secular bear market. We have reason to argue against that case and will explain in a forthcoming newsletter.