Anything Left In Stocks’ Tank After Rocket Thrust?

The stock market burst higher on Wednesday from already elevated conditions; has it spent all of its fuel, or could there be more in the tank?

The stock market burst out of its doldrums on Wednesday with the Dow Jones Industrial Average (DJIA) gaining more than 300 points. Many observers had surmised that, given the extended nature of the major averages, the next big mover of a day would likely be to the downside. We certainly sympathized with that argument. However, Wednesday’s rally was a firm reminder that the type of market melt-up that we’ve been witnessing can last longer, and go higher, than one might naturally expect. Still, the extended conditions from which the day’s rally commenced are noteworthy, and rare.

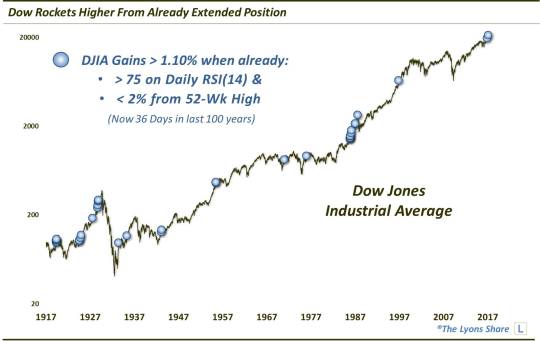

For example, the 14-day Relative Strength Index (RSI), a measure of momentum, on the DJIA was over 75 going into the rally. Anything over 70 is generally considered “overbought”. Secondly, the index was already sitting at essentially a 52-week high. The fact that the DJIA was able to muster enough fuel for the huge up day in spite of already elevated conditions puts it in rare company, historically.

Specifically, in the last 100 years, there have been just 35 other times in which the DJIA entered the day with an RSI above 75 and less than 2% from a 52-week high – and still managed to rally at least 1.1% on the day.

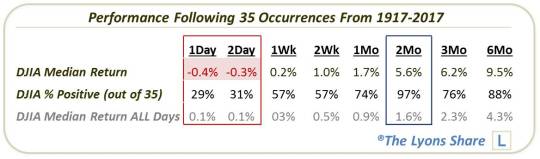

We took a look at those prior occurrences for clues as to whether the DJIA might still have something left in the tank – or whether it had likely spent its last fuel. As it turns out, there is minor evidence for an empty tank in the very short-term, but plenty of evidence to suggest a fuel reserve in the intermediate-term. Here are the aggregate performance figures following the prior 35 occurrences:

As one can see, 7 out of 10 times, the DJIA took a breather during over the next few days following its burst. However, the more compelling takeaway is that the DJIA has historically managed to follow through on its gains in the intermediate-term – at times, almost unanimously. From 1 month to 6 months later, the DJIA was higher at least 75% of the time, highlighted by the 2-month time frame over which 34 of the 35 events showed gains. That’s impressive.

So if today served as a reminder that a melting up market can continue to rise longer and, at times, faster than one expects, this study should reinforce that notion. For as extended as the market appears to be, history would suggest a strong possibility that there is more left in its tank.

_____________

Like our charts and research? Get an All-Access pass to our complete macro market analysis, every day, at our new site, The Lyons Share .

Disclaimer: JLFMI’s actual investment decisions are based on our proprietary models. The conclusions based on the study in this letter may or may not be consistent with JLFMI’s actual investment posture at any given time. Additionally, the commentary provided here is for informational purposes only and should not be taken as a recommendation to invest in any specific securities or according to any specific methodologies. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.