Another “Less Than Meets The Eye” Nasdaq Rally

Since the initial spike off the September lows, rally participation among all stocks has been lackluster; the Nasdaq provides us with more evidence of this.

The immediate stock market pop off the lows in September gave a significant lift to just about all issues. As we have mentioned in several posts, however, since that surge ended a month ago, the strength has not been widespread. The Nasdaq offers another eye-opening data point to illustrate that. Specifically, in the month since the initial surge ended, the Nasdaq 100 (NDX) has tacked on 6.53%. The broader Nasdaq market, however, has paled significantly in comparison during that time. In fact, over the past month, the cumulative number of daily advancing stocks minus declining stocks on the Nasdaq is actually negative. That is quite an internal contrast in the market. And it is extremely unusual for an NDX that is very near its 52-week high – at least over the past 15 years.

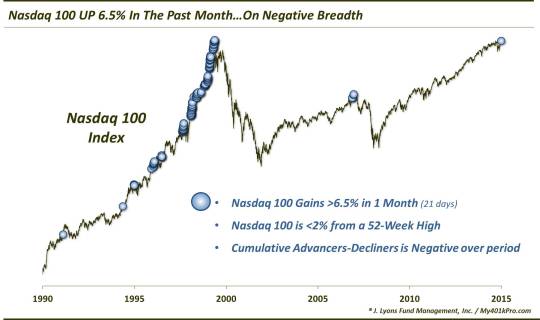

This chart shows all times since 1990 when:

- The NDX gained at least 6.5% over a 1-month span (i.e., 21 days)

- The NDX closed within 2% of its 52-week high

- The cumulative daily difference between Nasdaq advancing issues and declining issues was negative during that period (i.e., there were more daily decliners than advancers during the month

Like we said, this phenomenon has been unusual – during the last 15 years. Since the occurrence on March 27, 2000 – still the all-time high in the NDX, by the way – there have been just 4 days matching the criteria above. These 4 days were all in September-October 2007, marking the previous cyclical top.

Now before you go selling all of your stocks, take a peek at the lefthand portion of the chart. From 1990 to 2000, there were no fewer than 128 occurrences. And until 2000, none of the occurrences did much in the way of slowing down the Nasdaq juggernaut.

So which precedent is most appropriate here? Well, like many of the studies and research pieces that we have discussed over the past few months, that likely depends on what type of market climate we are in. The 1990′s, especially the latter half, was marked by an explosive, yet increasingly narrow rally in NDX stocks. As the chart shows, the index rolled right over the concerns about bad breadth for years.

Post-2000, however, has been a different story. Such breadth warnings and divergences have typically resulted in corrective action in the market during this period as the “few” were unable to continue to support the “many”.

So what type of climate are we in now? There is certainly compelling evidence for both cases at this point. On the one hand, we have seen in recent months and years the market power its way higher, 90′s style, in the face of any and every piece of structural concern that has crossed its path.

On the other hand, we are beginning to observe a degree of structural weakening and divergences that we have not witnessed since the prior two cyclical peaks in 2000 and 2007. Obviously, the market was not able to shrug off the internal weakening in those instances.

The manner in which the Nasdaq 100 deals with these current challenges will go a long way in revealing the type of climate we are in. At this point it is still yet to be determined. The index obviously took a shellacking in August (along with the rest of the market) following some egregious breadth divergences. However, it has come roaring back with a vengeance.

What camp are we in? It is our contention that the market remains with the confines of its post-2000 secular bear market. Thus, we would favor the latter camp. That is, we do not believe the Nasdaq 100, or the other leaders in the market will be able to carry the ever-increasing burden indefinitely. That doesn’t mean the market is in danger of imminent collapse. However, the more support that gets taken away, the more vulnerable this house of cards will be.

_____________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.