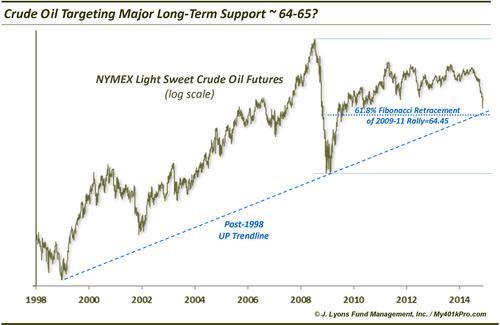

Where Will Spill In Oil Prices Be Contained?

The ongoing drop in oil prices accelerated in the past 2 days with the decision by OPEC not to cut production. With Light Sweet Crude Oil Futures now down 35% from their June highs, many market participants and industry insiders are wondering where this drop in prices might finally be arrested. While there are obviously many factors driving prices, including unpredictable geopolitical forces, it still comes down to supply and demand. And nothing portrays the supply/demand picture like prices themselves. Therefore, going strictly off the charts, we have identified one price level that may serve as potential support to plummeting oil prices. That level is around 64-65 dollars per barrel.

There are 2 major chart developments converging near this 64-65 level:

- The long-term UP trendline, connecting the 1998 and 2009 lows

- The 61.8% Fibonacci Retracement of the 2009-2011 rally

As we mentioned, there are a great many factors that go into determining commodity prices. This is particularly true with oil given its importance economically, politically and security-wise to many nations and regions around the globe. Therefore, it is more subject to exogenous shocks, both ways, based on the interests of those entities.

However, going strictly off of the chart, 2 major factors are alligning near the 64-65 level. If one is looking for a spot where the current slide in oil prices may be arrested, that might be one area to look at.

____

“Oil Spill” photo by Thomas Ritter.

Read more from Dana Lyons, JLFMI and My401kPro.