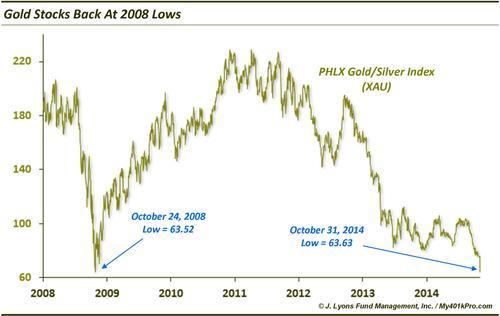

Gold Stocks Back To 2008 Lows

Most everyone is aware of the struggles gold stocks have been having, not only recently, but for a few years now. However, the extent of the struggles perhaps has not fully been grasped. How bad has it been? As represented by the PHLX Gold/Silver Index (XAU), gold stocks have now come all the way back to their 2008 lows.

The low on the XAU Friday was 63.63. The low in the 2008 crash came on October 24 at 63.52. So much for the bull market.

So is it finally time for at least a bounce in gold stocks? Is the blood running in the streets? Probably some is, yes. It is not our strategy to attempt to catch falling knives. If we were to attempt it, the knife would have to be hitting some MAJOR potential support level. You certainly can make the case for that here with the XAU hitting 6 year lows, precisely.

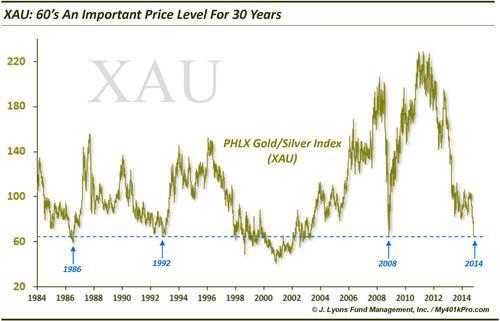

On top of that, the 60’s area has been a level of significance for longer than just 6 years. It has actually served as support going back to the mid-1980’s.

As this longer-term chart shows, the XAU formed lows in 1986 and 1992 in the mid-60’s area. And except for a few years in the early 2000’s this 60’s area has served as the low for the past 30 years.

We are not rushing to pour money into gold stocks at the moment. Our preference is to see strength in an area before committing capital. However, again, for a trade, if we were to attempt such a knife-catch, it would be done at a major level. A very reasonable argument can be made for that now as it pertains to gold stocks.

________

More from Dana Lyons, JLFMI and My401kPro.