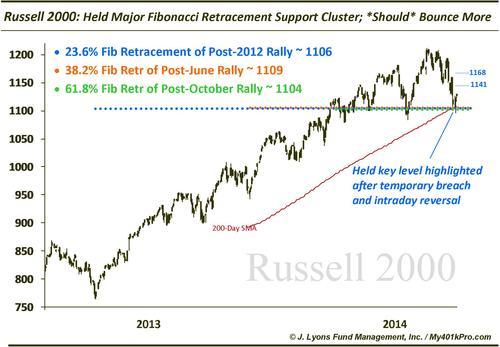

UPDATE: Russell 2000 Held @ Key Level Highlighted; *Should* Bounce More

How far will it bounce? If it is to be any type of meaningful reversal and bounce (let alone another V-bottom) it should at the very least retrace 38.2% of the decline from March. That is approximately the 1141 level. Considering the importance of the level from which it reversed, a 61.8% retracement to about the 1168 level isn’t out of the question…and would not even change the deteriorating intermediate-term picture. We’ll be monitoring this bounce closely.

* Corresponding levels for the $IWM would be 113.25 (38.2) and 116 (61.8).