ChOTD-5/29/14 Corporate Profits vs. Core CapEx

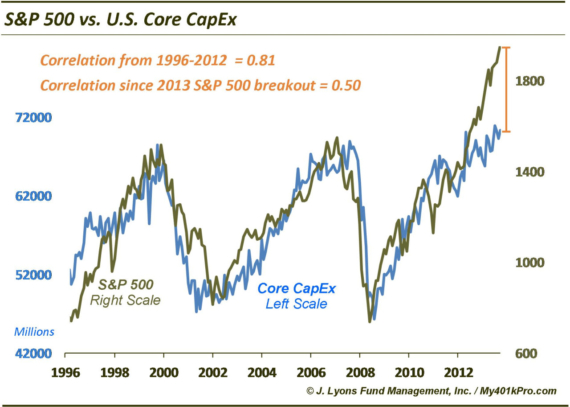

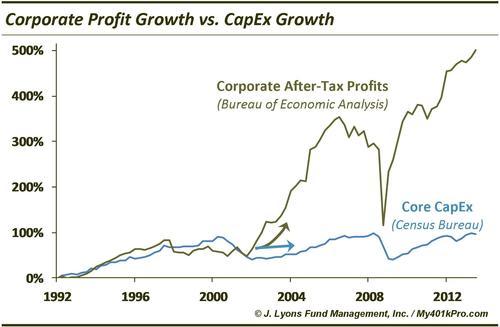

Sticking with the CapEx theme (yesterday, we looked at Core CapEx vs. the S&P 500), today’s ChOTD shows the growth of Corporate Profits vs. Core CapEx growth since 1992:

After the two series tracked each other very closely for a decade, the last dozen years have seen a wide – and widening – divergence. Corporate Profits have soared (minus the brief, devastating blip during the “great recession”) while CapEx has stagnated. Presumably these two trends are not mutually exclusive. We will let the econ wonks debate it but, like yesterday, we’ll pose a few question for them:

1) To what extent is the rise in profits (& margins) due to benign CapEx behavior?

2) What happens to profits and margins when companies are forced to catch up on CapEx?

3) What sort of EPS theatrics will companies resort to in order to meet estimates?