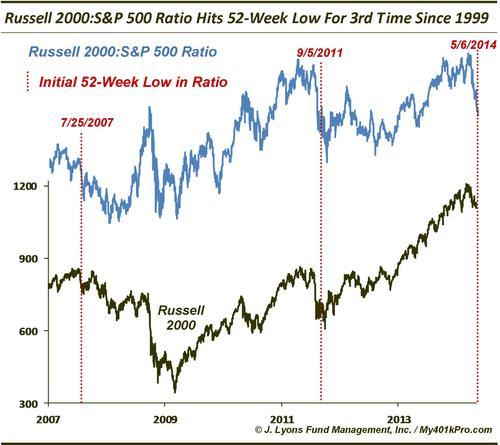

ChOTD-5/7/14 Ratio Of Russell 2000:S&P 500 Hits New 52-Week Low For Just 3rd Time Since 1999

It’s no secret that the Russell 2000 Small-Cap Index has been pummeled as of late. At the same time, the S&P 500 Large Cap Index has held up rather well. Today’s ChOTD of the ratio of the Russell 2000:S&P 500 (essentially small caps:large caps) quantifies that discrepancy for historical context.

As the chart illustrates, the Russell 2000:S&P 500 ratio reached a 52-week low yesterday, indicating the extent of the carnage in small caps since the Russell hit a 52-week high just 2 months ago. And in fact, it is just 3rd new 52-week low in the ratio since 1999 (we are only including initial new lows here, not each subsequent low in a string of 52-week lows.) The other two 52-week lows occurred on 9/5/2011 and July 25,2007. The 2011 occurrence happened after most of the damage had been done and the market bottomed a month later. The 2007 occurrence marked just the initial blow in the 2007-2009 cyclical bear market.