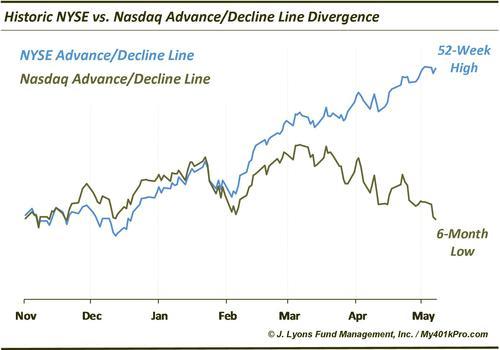

ChOTD-5/8/14 Historic Divergence Between NYSE, Nasdaq Advance/Decline Lines

Several of our recent ChOTD’s have revealed the significant deterioration in some areas of the market (i.e., Nasdaq, small-caps, biotech), either on an absolute basis or relative to other areas. Today’s ChOTD may just take the cake in terms of illustrating the stark contrast between the beaten down Nasdaq stocks and the rest of the market that has hung up rather well.

As the chart shows, the NYSE Cumulative Advance/Decline Line is currently at a 52-week high (or just off it by a few issues). At the same time, the Nasdaq Advance/Decline Line is at a 6-month low. Such a divergence is truly historic. We have found only 2 other occasions in which this occurred: the end of 1996 and mid-July 2004. Following those two occasions, stocks struggled for another 1-2 months before resuming uptrends. Based on those 2 examples, therefore, it would seem there is not much here but an interesting statistic. Intuitively, however, it is another in a string of recent developments that have us concerned about the market in the intermediate-long term.