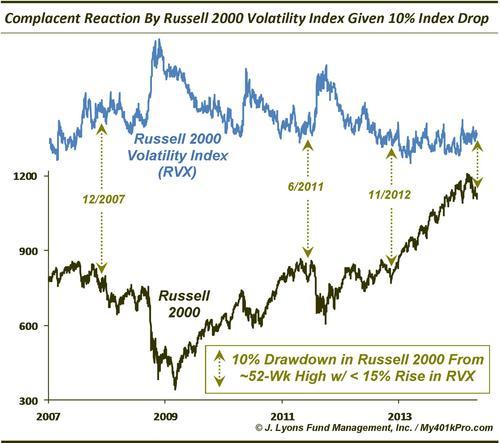

ChOTD-5/9/14 Complacent Reaction By Russell 2000 Volatility Index To The Russell 2000 Selloff

Much attention has been given, including our post here, to the significant weakness in the Small-Cap segment of the market, in particular relative to the rest of the market. Interestingly, however, by one measure, despite all the attention there has been a relatively benign reaction to the weakness on the part of traders. The Russell 2000 Volatility Index (RVX) is typically a reliable gauge of the degree of fear or concern in the market regarding future price action. The higher it spikes, the more concern it is displaying. Despite the recent Russell 2000 weakness, the RVX has only risen a modest amount.

Specifically, the RVX has only risen about 11% over the past two months as the Russell 2000 has dropped roughly 10% from its all-time high during that time. Looking back at its history (our data only goes back to 2006), the Russell 2000 has dropped 10% from a 52-week high with the RVX rising less than 15% on just 3 other occassions: December 2007 when the cyclical bear market was just getting going, June 2011 which preceded a near 20% correction a few months later, and November 2012 after which the market bottomed immediately and never looked back.

While a small sample size, this is another study, like others we’ve looked at recently, that gives us concern regarding the health and sustainability of the market rally over the intermediate to longer-term.