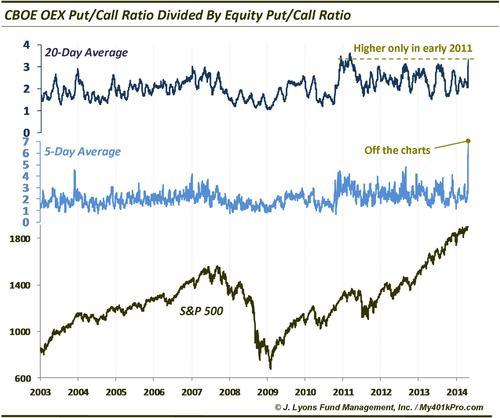

ChOTD-6/11/14 CBOE OEX:Equity Put/Call Ratio Showing Historic Caution

Today’s ChOTD shows the ratio between one supposed smart money put/call ratio (CBOE OEX P/C) to a supposed dumb money put/call ratio (CBOE Equity P/C).

This indicator (which we first observed at sentimentrader.com) theoretically provides a warning when readings are high (more relative put buying by the smart vs. dumb money) and a green light when low (more relative call buying by smart vs. dumb money). With the OEX put/call ratio registering very high readings lately (i.e., smart money is buying puts) and the Equity put/call ratio at very low levels of late (i.e., dumb money is buying relatively very few puts), the ratio of the OEX:Equity P/C ratios is extremely elevated, in fact, historically so. In the last 11 years, the 20-day average of the OEX:Equity Put/Call Ratio has only been higher than it is now in early 2011. Furthermore, on a 5-day and 10-day (not shown) basis, the ratio has never been higher.

This would appear to have negative implications on the market given that the “smart” money is selling and the dumb money is buying. Indeed, elevated levels in 2004, 2007 and 2011 preceded stagnant to calamitous markets. There are a few caveats, however:

- We have found this CBOE Put/Call data to be of less value in recent years than it has historically been

- The OEX Put/Call series has generated a few abnormal, even alarming, readings over the past week. Thus far there have been no revisions from the CBOE, however, so we have reason yet to dismiss the figures