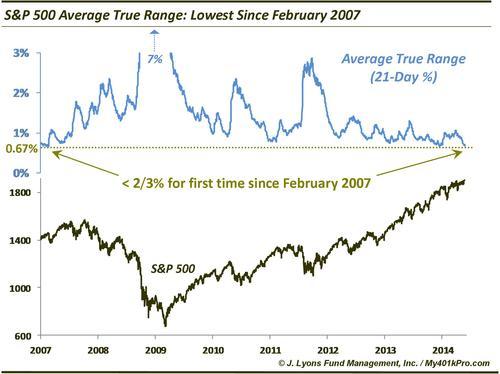

ChOTD-6/18/14 S&P 500 Average True Range: Volatility Measure Lowest Since February 2007

Touching on the pervasive “low-volatility” theme, today’s ChOTD looks at the Average True Range of the S&P 500 since 2007.

Average True Range is a measure of volatility that essentially tracks how much a market moves either from day to day or intraday. Typically we look at a 21-day average of this indicator to filter out noise and detect the trend. As the chart shows, the 21-day ATR closed yesterday at its lowest level since February 2007. At 0.66%, the ATR of the S&P 500 is now below 2/3 of a % for the first time in over 7 years. And while the low-volatility environment can persist for awhile, when it breaks out, it often does so in a big way, i.e., 2007 and 2011