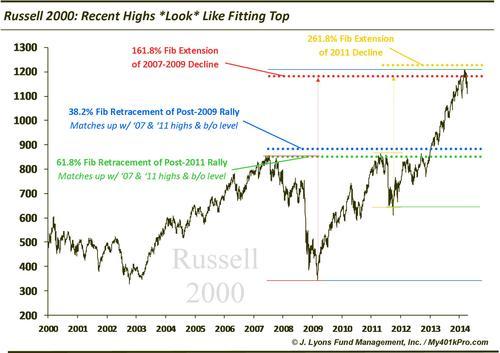

ChOTD-6/2/14 Why The Recent High *LOOKS* Like A Fitting Top: Russell 2000 Edition

Today’s ChOTD is the first in a series of charts outlining how recent index highs pass the so-called market top “look test”. By that we mean that these indices reached, or are reaching, approximate levels that based on various backward and forward-looking charting analysis (primarily Fibonacci) project as logical topping areas. While markets rarely conform to such convenient behavior, given the convergence of multiple key levels on multiple indices, we thought it worthwhile to at least mention. In this era, it probably does not go without saying that we are not “calling” a top necessarily. We are merely pointing out the presence of these significant levels on various indices. For example, today we look at the Russell 2000:

The recent Russell 2000 high occurred at an area in close proximity to key levels according to two Fibonacci analyses. First, these backward-looking extension levels:

-

161.8% Fibonacci Extension of the 2007-2009 decline

-

261.8% Fibonacci Extension of the 2011 decline

Now the forward-looking. This is almost like reverse-engineering a top by projecting where key future Fibonacci support levels would be based on a hypothetical “top” level. For example, given the level of the recent high in the Russell 2000, future key retracement support would be found at these levels:

-

38.2% Fibonacci Retracement of the post-2009 rally roughly lines up with the 2007 and 2011 highs, as well as the breakout level in 2013

-

61.8% Fibonacci Retracement of the post-2011 rally also roughly lines up with the 2007 and 2011 highs and 2013 breakout level

Again, we will reiterate that we are not calling a top. We are merely pointing out the convergence of very key levels near or based off of recent highs in the Russell 2000. That said, given the multitude of concerning developments in the market recently, we would certainly not be surprised if a top does develop in this approximate area, despite the convenient and telegraphed nature of this analysis.