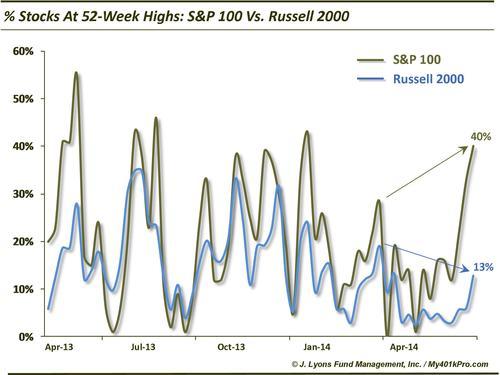

ChOTD-6/9/14 % Of Stocks @ 52-Week Highs: S&P 100 Vs. Russell 2000

Today’s ChOTD comes out of the bottomless “divergence barrel”. This one looks at the % of 52-week highs among S&P 100 constituents vs. Russell 2000 constituents.

A couple things stand out. One is the absolute level of new highs on the S&P 100. 40% is a pretty respectable figure, especially given all the hand-wringing recently about the lack of new highs (largely justified, in our view.) Secondly, the % of $OEX new highs surpassed the March high. This is constructive (although, markets have topped before even as new highs made a very short-term higher high. It would be much more constructive if it could surpass the 43% late-December figure.) Meanwhile, the % of Russell 2000 stocks at 52-week highs is not only paltry at 13%, but it’s not even close to its high from early March. This is a poor trend for small caps.

Our main takeaway is the importance of maintaining focus on relative strength. The figures are not necessarily immediately bullish or bearish for the broad market. However, on a relative basis, the large cap space is still the desired territory for those looking to mine for long positions. There are plenty of targets available in that space still.