MidCaps: 15-Year Relative Strength Breaking Down

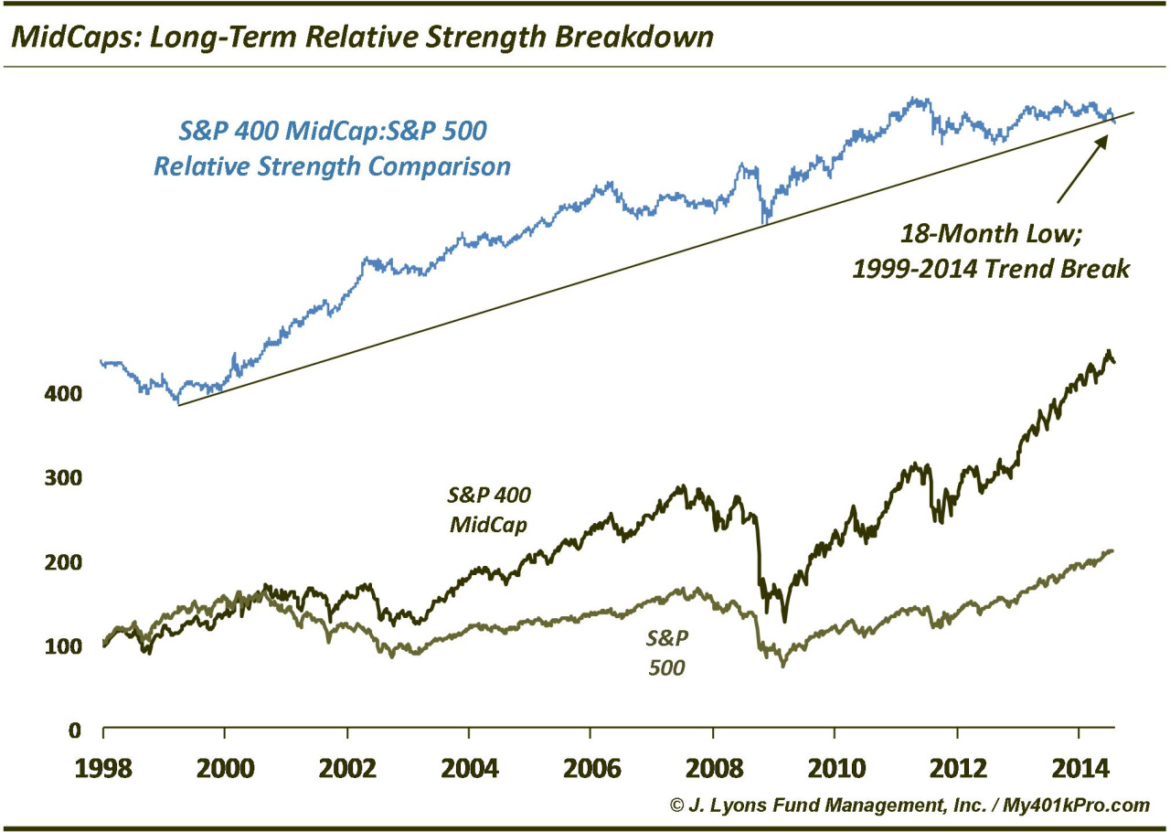

Several months ago, we began noting relative breakdowns in key areas of the market. It started first in the bubbly, momo sectors of the market like biotechs and social media stocks. Then it spread to smallcaps. Now we can add another group to the list and it’s a big one: midcaps. As displayed in the chart, midcaps have exhibited relative outperformance versus the S&P 500 since 1999. The uptrend line in that relative outperformance is now breaking.

On an absolute basis, the S&P 400 Midcap Index has suffered very little in the way of damage, except on a very short-term basis. It was at an all-time high as recently as the 1st of this month and is barely below the 50-day simple moving average, as of this writing. That is one of the benefits of “relative strength” analysis. It can provide advance warning that a move is pending, almost like looking into the future. If the relative breakdown is foreshadowing an absolute breakdown in midcaps, investors can take action before too much damage is done to their portfolio.

Of course, the crystal ball isn’t always right. And often, like divergences, even if it is right it can be very early. Therefore, any pending midcap (or major market) breakdown does not have to be imminent. That good news, however, is likely diminished by the fact that, while the break down is just occurring now, midcap relative strength stopped improving some time ago. The S&P Midcap:S&P 500 ratio actually peaked in 2011. Therefore, the relative strength advance warning may already be several years in.

Some might argue that this development is just a sign of rotation into large caps. We don’t necessarily buy it in this instance. With the market 5 years into a cyclical advance, it is likely a sign of broad weakness. The only positive spin is that large caps have simply held up better. Further evidence of that conclusion, we believe, is that the Midcap:S&P 500 ratio is at an 18-month low. That kind of reading typically occurs at washed-out lows, as it did near the bottom in 2008. Witnessing this development while just off of the all-time highs is a sign that another peg is being removed from the foundation of this rally.