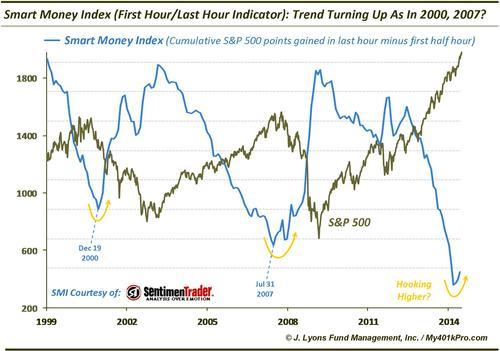

ChOTD-7/16/14 Smart Money Index (First Hour/Last Hour Indicator): Trend Turning Similar To 2000, 2007?

Today’s ChOTD looks at an interesting indicator called the Smart Money Index (as coined by Jason Goepfert at Sentimentrader.com). The indicator tracks the timing of market moves intraday under the notion that different investor types trade at different times of the day. Specifically, per Goepfert:

The idea behind this indicator…is that emotional trading takes place at the beginning of the trading day (as traders react to overnight news event and economic releases) while the “smart money” takes the day to evaluate price action and input their orders before the market closes.

Due to that assumed tendency, we want to bet against the opening action and bet with the closing action. The way we calculate the index is to subtract the performance of the S&P 500 cash index during the first ½ hour of trading and to add the performance of the S&P during the last hour.

Originally considered most relevant for short-term analysis, an interesting longer-term pattern in the indicator has emerged.

Intuitively, one might think that long-term uptrends are supported by late-day “smart money” buying and, thus, a rising Smart Money Index. However, when tracking the SMI on a cumulative basis over the last 15 years, the indicator has trended lower, in general, during cyclical uptrends and higher during cyclical downtrends. Why is that? Perhaps it is due to the gap open effect, wherein much of the daily market change is reflected by the opening gap rather than the price change in the first half hour.

Whatever the cause, a clear pattern has persisted over those 15 years. Included in that pattern is the tendency for the SMI to turn higher near cyclical peaks in the market. Indeed, the indicator reversed higher in December 2000 and again beginning in July of 2007. While these are only 2 data points, their significance in terms of timeliness and the lack of “false” up turns make the recent potential turn higher something of a longer-term concern.