ChOTD-7/18/14 High Yield:Treasury Bond Ratio @ New 52-Week Low

Many of the subjects of our ChOTD’s over the past several months have focused on the behind-the-scenes weakening of the high-risk, high-beta areas of the market. In our June Newsletter, “Cracks In Market Chemistry”, we likened such volatile market sectors to moody superstar athletes. When they are happy and producing, they can propel a team to great heights. However, when they become disgruntled, their behavior can effect the entire chemistry, and performance, of the team. So it is with high-beta market sectors, i.e., small caps, Nasdaq stocks, bubbly sectors like biotech and social media, etc. and their influence on the overall market.

One other area we could include in that group, although it is not equity-based, is high yield bonds. When they are moving up, it is indicative of a certain comfort with risk-taking which can fuel a momentum move higher. However, when they stop going up, it signifies a reduction in willingness to partake in high-risk areas – and possibly a warning to the general financial market as a whole. That situation is upon us:

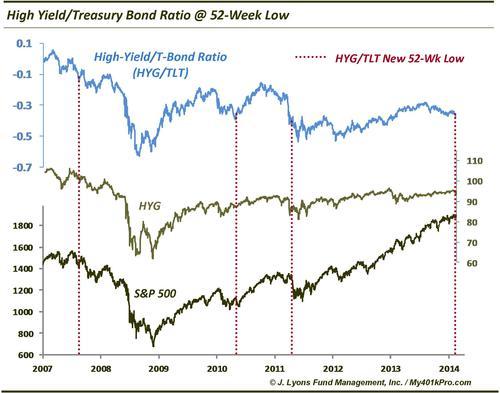

Measured relative to a “safe” class of fixed income, Treasury Bonds, high yield actually hit a 52-week low yesterday (specifically, we are using the ratio between the iShares High Yield ETF, $HYG, and the iShares 20+ Yr Treasury Bond, $TLT.) Considering that $HYG was at a 52-week high 3 weeks ago, this is a remarkable development, and one that happened remarkably fast.

Looking at the history of $HYG, we find 3 other distinct times that its ratio to $TLT hit a new (i.e., first in awhile) 52-week low. These occurred in November 2007, August 2010 and August 2011. The 2010 and 2011 incidents occurred after much of the de-risking had already taken place, although the ratio had been deteriorating for some time, providing plenty of warning. The 2007 occurrence obviously took place early into the cyclical decline in risk assets. While we aren’t suggesting the 2007 result necessarily has to be repeated, there is one thing that concerns us especially. This ratio is hitting a 52-week low with very little damage haven yet been done to the market, on an absolute basis. $HYG is only 3 weeks off its 52-week high and the S&P 500 is a mere 2 weeks removed. Therefore, if the 52-week low in the HYG/TLT ratio is issuing a valid warning to the market, the potential further downside is considerable. That remains to be seen, but we consider this to be another of the longer-term concerns that are piling up quickly.