Secular Stock Volume Decline Not Unprecedented

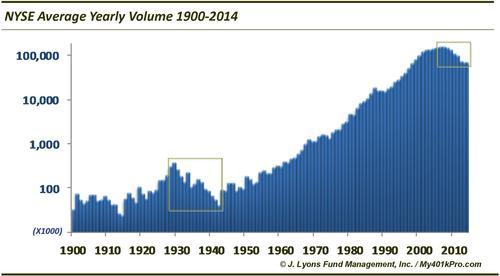

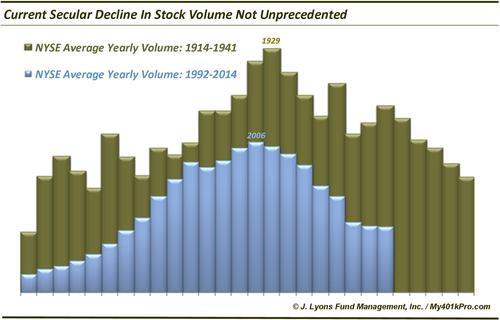

There has been a lot of focus and debate recently regarding the multi-year decline in volume in the U.S. equity market. One thing that we do know is that it is not the first secular (long-term) volume decline in U.S. history. There was a similar (to this point) decline from 1929 to 1941.

The proximate cause of the current volume decline is up for debate. Is it mainly a structural issue wherein volume is moving from the equity market into options and futures where volume has been increasing (see Ryan Detrick’s excellent post on this phenomenon.) Or is it a function of the investment environment and its effects on investor psyche? In our view, the latter should not be dismissed as a potential cause due to the timing of the decline, specifically as it compares to the secular volume decline from 1929-1941. That comparison is Our Chart Of The Day.

Both periods in the chart began with a massive increase in volume as the respective secular bull markets took hold. In the first period, NYSE volume peaked in 1929 and declined until 1941. While we don’t have the luxury of countless market metrics from that era like we do today, we don’t think it’s a stretch to say that dour investor psychology stemming from the Great Depression and simultaneous secular bear market had much to do with the volume decline.

In the present circumstance, NYSE volume peaked in 2006 just before the 2nd peak of the secular bear market leading to the 2007-2009 market decline (Nasdaq volume peaked in 2008). Volume has been declining ever since. We believe, as during the Great Depression period, the second market rout of this decade had a damaging effect on investor psychology and has kept the “marginal” investor from returning to the market. This despite new highs in the major averages.

Will the new highs bring volume back into the market? Or will the secular volume decline continue for several more years like it did in the 1930’s? It remains to be seen, but 12 months into new high territory on the S&P 500 has not brought an increase in volume yet. Readers of ours are aware of our view that once the current cyclical bull market runs its course, the equity market is at great risk of a relapse back into the post-2000 secular bear market (read here for more). If that becomes a reality, a continuation of the volume decline would not be a surprise.