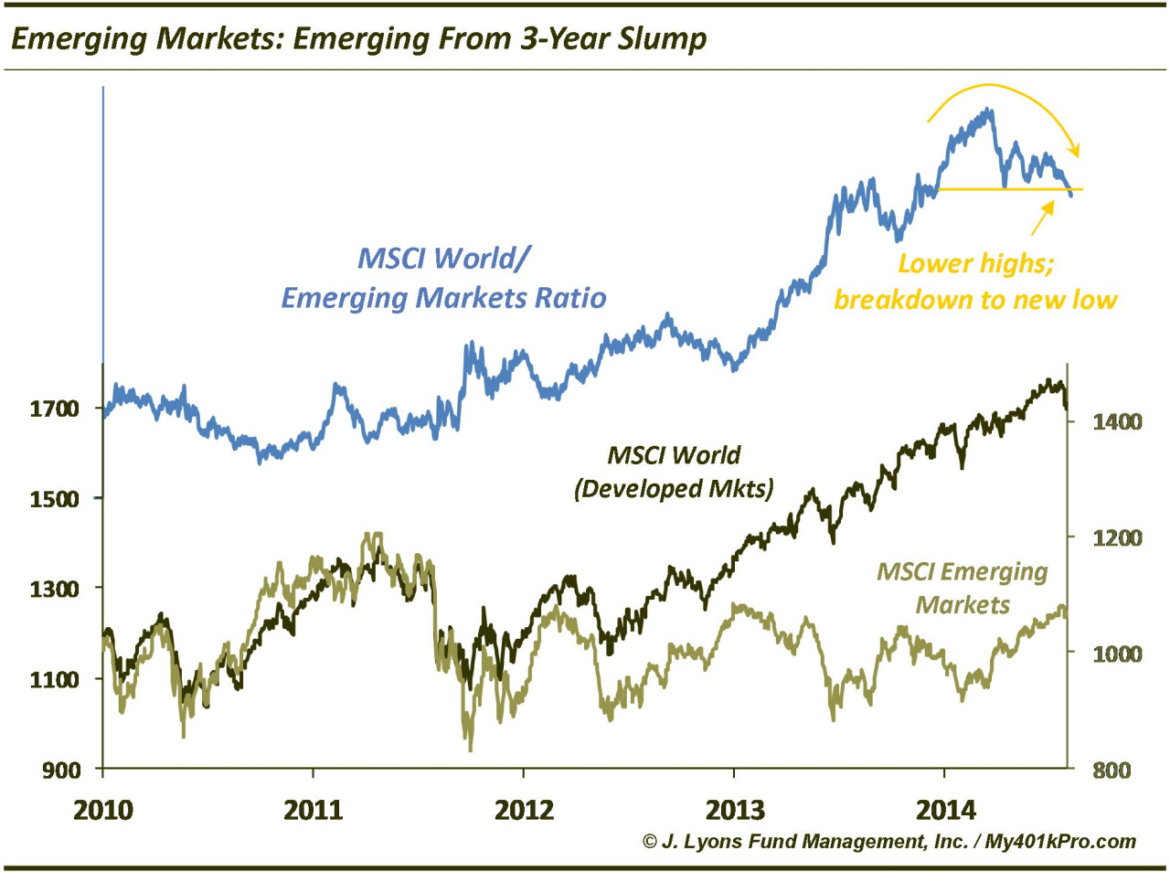

Emerging Markets emerging from 3-year slump

We temporarily interrupt the new-found short-term equity market volatility and its accompanying hyper-sonic rise in investor fear to take note of an emerging development on a longer-term scale. After 3 years of languishing performance (on both a relative and absolute basis) emerging market (EM) equities are starting to turn things around. No, we are not the first to note the recent strength in emerging market equities as the MSCI Emerging Market Index is up some 15% since February. However, as our Chart Of The Day shows, EM stocks have been demonstrating key improvements on a longer-term scale that suggests this isn’t merely another short-term bounce.

The chart displays the relative strength, or ratio, between the performance of developed markets (DM), as represented by the MSCI World Index, to that of the MSCI EM Index. After trending up for the past 3 years, there has been significant deterioration in the relative strength of DM (and conversely, improvement in EM). Note that for the first time in 3 years, there is a clear lower high in the relative strength of DM since the ratio peaked in March. Additionally, in just the past few days, the ratio has broken below its prior short-term low set in April. Thus we have a pattern now of lower highs and lower lows for DM, and thus higher highs and higher lows for EM.

Sure a good deal of the recent relative improvement in emerging markets’ favor has to do with the heavy selling in developed markets over the past few weeks. But that does not diminish the relative improvement. For a market segment that has been beaten down for 3 years like EM has, the ability to withstand broad market selling pressure tells you a great deal about how much money has already fled that area (a lot) and how much more potential selling is left (not much). Besides, flat performance is still relative strength if the alternative means sizable losses in DM.

Emerging markets have already rallied quite a bit this year and could very well pause here in the short-term near the highs of the past few years, especially if the selloff continues in the developed markets. However, from a longer-term perspective, for investors who have been awaiting the re-emergence of EM, it appears to be underway.