CBOE SKEW: Tail Risk Indicator Attains Dubious Record In July

We’ve talked about the CBOE SKEW Index plenty over the past few months, given its unprecedented behavior. We thought it was worthy of one more Stat Of The Day, however. Once again, the SKEW basically measures the demand for out-of-the-money left tail equity options. It usually ranges from 100 to 150 with readings above 130 considered extreme, i.e., the demand is high for those “tail risk” options.

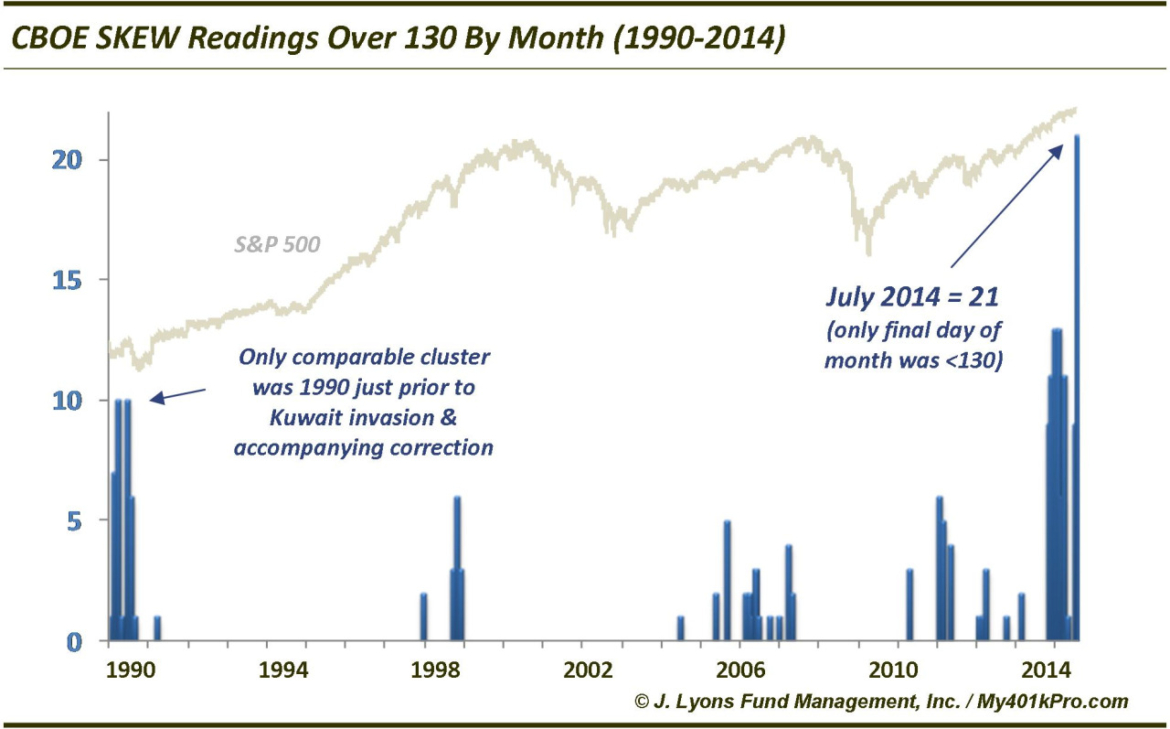

The chart shows the number of readings above 130 in each month since the SKEW began being reported in 1990. July’s reading is, shall we say, skewed. The SKEW registered over 130 on every day of the month in July except for the last one. Though there were a few months over the past year that saw double digit readings above 130, no other month in 24 years comes close.

The only other cluster of readings in double digits came in 1990. Those months preceded Iraq’s invasion of Kuwait and the accompanying selloff in the market. Will the current readings be as prescient? Only time will tell but it certainly is aberrational behavior.

There seems to be a lot of that going around.