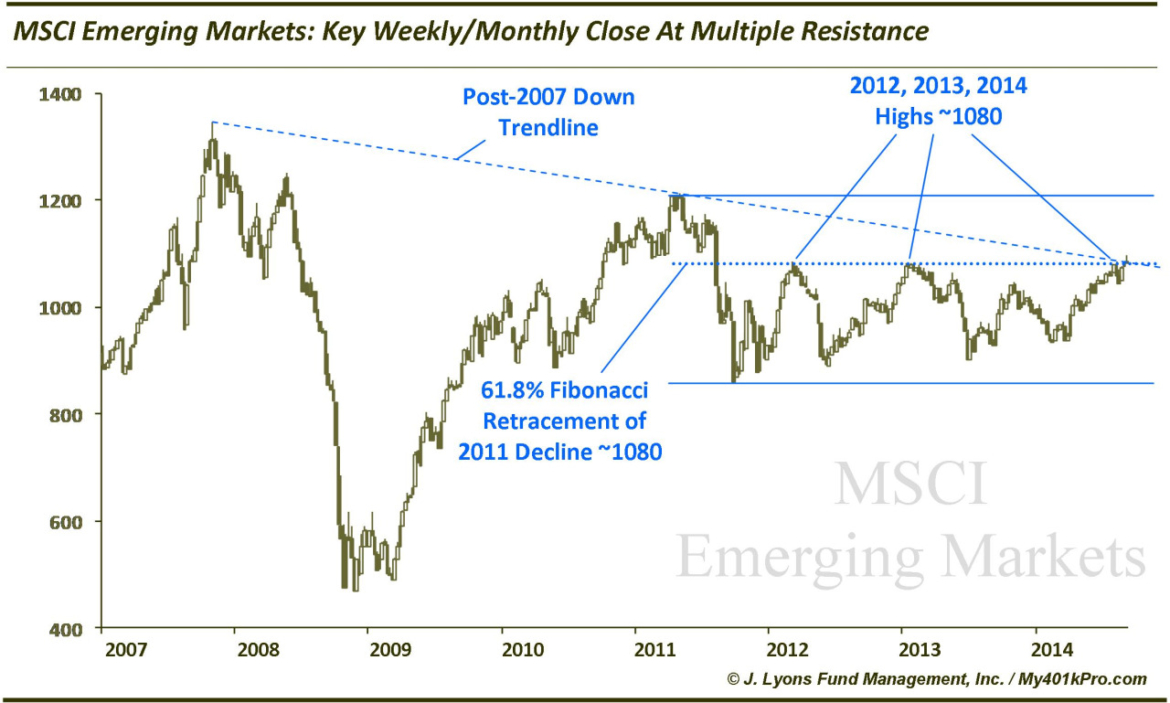

Emerging Markets face key weekly/monthly close at multiple resistance

Over the past several months, we have grown increasingly constructive on a possible longer-term bottom developing in emerging markets. Reasons for our optimism can be seen in various posts on Latin America, India, China, Russia and Emerging Markets in general. We have a more comprehensive report on the topic forthcoming.

That said, the MSCI Emerging Markets Index faces an important weekly and monthly close today. Multiple key layers of resistance lie in proximity to current prices around 1080. These include:

- The post-2007 down trendline connecting the 2007 and 2011 peaks

- The 61.8% Fibonacci Retracement of the 2011 decline

- The intermediate-term highs set in 2012, 2013 and July

The index (tracked closely by the iShares Emerging Markets ETF, EEM) attempted to break above this key resistance this week, in particular on Wednesday. Yesterday saw a higher open on initial follow-through to Wednesday’s breakout. However, the index reversed to close lower, forming a bearish engulfing pattern on the daily bar. After initially attempting to move higher again this morning, the EM index and ETF have again reversed lower. If the key resistance levels listed above cannot be overtaken today, it will be a good head’s up that emerging markets are not yet ready to take off…despite the positive long-term developments.