Stocks Entering Best Stretch of Presidential Cycle…By Far

Most investors are likely familiar with the Presidential Cycle as it pertains to the stock market. It refers to the tendency of the stock market to generally conform to a certain trading pattern throughout the course of a 4-year Presidential term. While the market obviously doesn’t follow the pattern in lockstep every year, it actually has been pretty consistent historically.

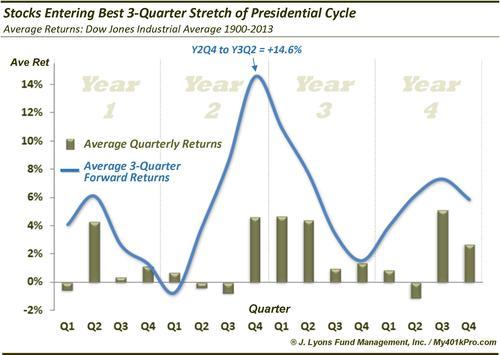

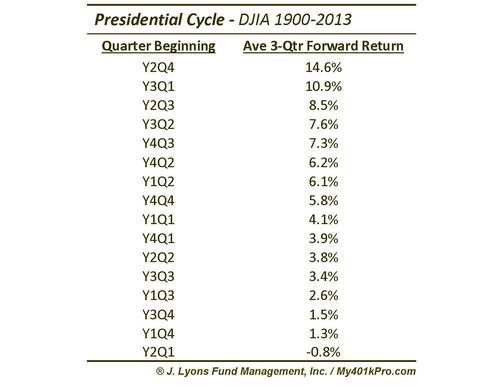

In terms of the market’s current position, bulls will be heartened to hear that stocks are now entering the strongest stretch of the entire cycle. From the 4th quarter of the 2nd year of a president’s term (begins October 1st) through the 2nd quarter of the 3rd year (June 30 next year), the Dow Jones Industrial Average has averaged a 14.6% return since 1900. This is far and away the best of any 3 quarter stretch.

This very positive stretch contains 3 of the best 4 performing quarters of the entire Presidential Cycle, on average. Thus, it is not surprising that no other 3-quarter stretch comes close to the one coming up.

Now, despite the positive average return over this stretch, we will reiterate that these seasonal type indicators are general tendencies, averaged over a long period. It is not a guarantee that stocks will conform to this pattern during this cycle. Case in point – the last time we posted regarding the Presidential Cycle was 6 months ago. That post pointed out the mirror opposite of this one: that stocks were entering the weakest 2-quarter stretch of the entire Presidential Cycle. Well, far from dropping over the past 2 quarters as it had done on average since 1900, the Dow posted positive returns in both the 2nd quarter and 3rd quarter (as of yesterday), totaling roughly 4%.

The takeaway? Seasonal patterns and cycles are general tendencies formed over long periods. As such, they should be treated as secondary indicators. That said, the Presidential Cycle has been one of the more consistent seasonal cycles. Therefore, while it is not a lock, the next 3 quarters should provide a slight tailwind for stock investors.

(Check out Ryan Detrick’s blog, the Almanac Trader blog and this teriffic post from Urban Carmel for more information on the Presidential Cycle).

________

More from Dana Lyons, JLFMI and My401kPro.