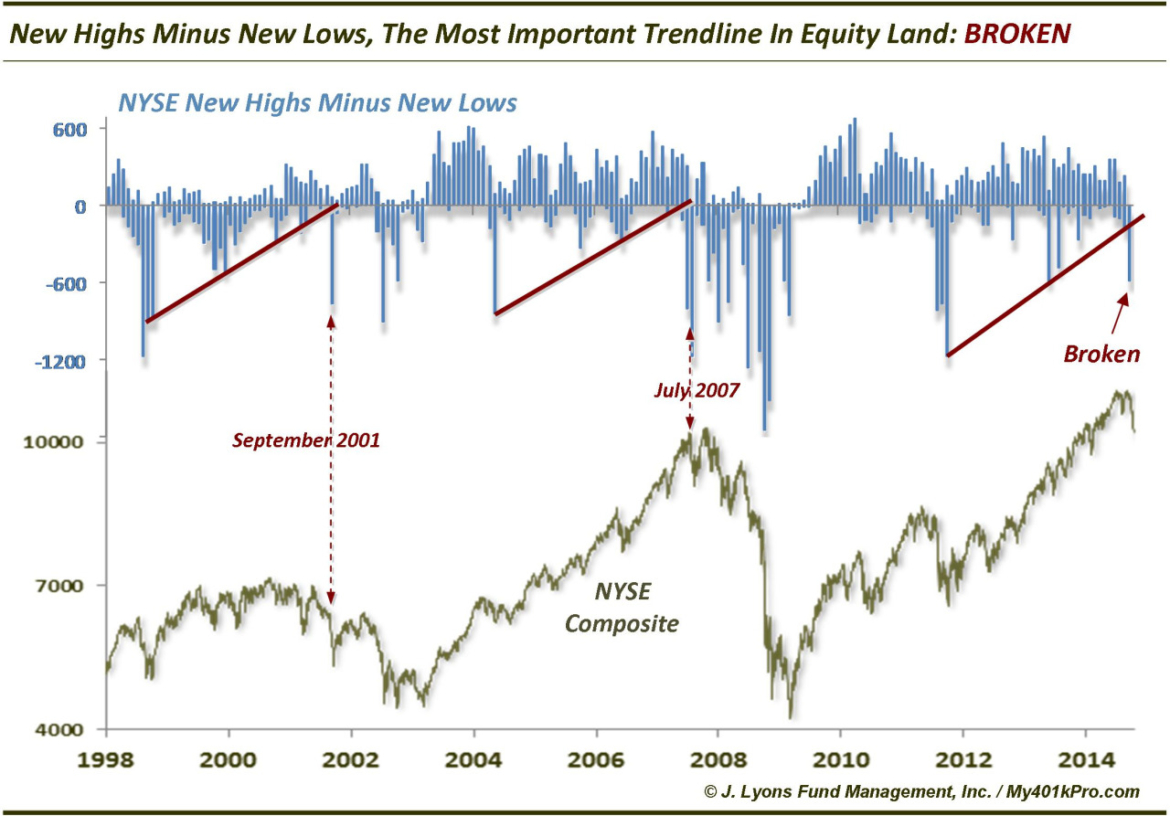

UPDATE: The Most Significant Trendline In Equity Land = BROKEN

On September 25, we presented what we termed, The Most Important Trendline In Equity Land, namely the NYSE New Highs minus New Lows. While the divergence in New Highs over the past year was transparent and concerning, the lack of expansion in New Lows countered the concern. And as long as the well-defined trend of higher lows in the difference in New Highs-New Lows continued apace, the potential risk associated with the thinning of the cyclical rally remained at bay. Only when the uptrend in New Highs-New Lows was broken, would such “potential” risk become a realization. As of yesterday, that trend is unambiguously broken.

Now before you start complaining that the horse is already out of the barn considering the on-going near-10% correction, the broken trendline is not a short-term concern. Indeed, such extremes in New Highs-Lows often come near short-term lows. As we pointed out in the September 25 post, the concern has longer-term ramifications. Just as in September 2001 and July 2007, this trend break runs the risk of eventually leading to a more serious cyclical bear market.

So while the market is undoubtedly washed out here in the short-term and will likely form an intermediate-term low within days or weeks, the longer-term cyclical bull has now been dealt a staggering blow.

________

More from Dana Lyons, JLFMI and My401kPro.