Small vs. Large Cap Quarterly Divergence Last Seen in 3Q 2007

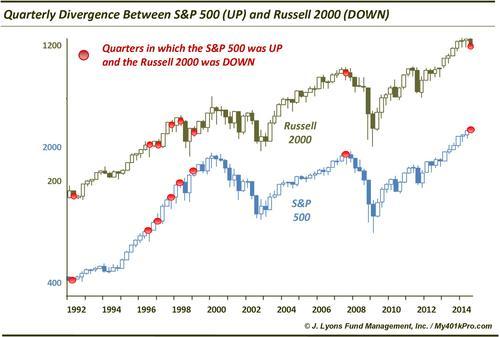

The 3rd quarter produced yet another divergence among large and small cap stocks. While the large cap S&P 500 index gained 0.6%, the small cap Russell 2000 actually lost ground, finishing 7.7% lower for the quarter. In our database of the Russell 2000 (back to 1991), this is the 8th such quarterly divergence between the two indexes.

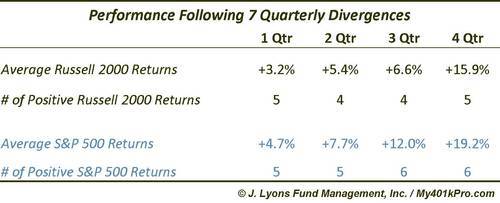

While this is a pretty small sample size, returns going forward were actually fairly positive. This should come as no surprise, however, as most of the examples occurred during the blowoff phase of the secular bull market in the mid to late-1990’s.

Despite these positive average returns, there were a few inauspicious dates within the sample that present a concern regarding the present situation. The two troublesome occurrences were the 2nd quarter of 1998 and the 3rd quarter of 2007.

Following the 1998 example, the S&P 500 dropped over 10% in the 3rd quarter and the Russell 2000 lost more than 20%. The 2007 occurrence, which is the only divergence in the past 15 years, of course immediately preceded the cyclical top in stocks.

Why would we place any more weight on those two examples than any of the others – or to the overall average? The circumstances are arguably more similar to the market’s present situation than some of the others. The market is now 5 years into a cyclical bull market and beginning to show signs of a breakdown in the breadth of its rally, i.e., the negative divergence among small caps. This is similar to conditions in 1998 and 2007. Yes, occurrences in 1997 and 1999 also displayed similar characteristics. However, all gains made by the Russell 2000 following the late 1997 divergence were wiped out by the 1998 correction and the post-1999 gains were wiped out after the 2000 blowoff top.

We are not dismissing the positive average performance following such divergences. Indeed, that is why these things should always be vetted. The divergence, historically, has not been the immediate death knell that some may think. That said, the results should not be treated within a vacuum either, particularly considering the limited sample size. We are big proponents of market breadth as it relates to the health of a market – i.e., the more stocks participating, the better. Therefore, the current iteration of this divergence, based on our other analysis, strikes us as more of a concern than the average stats would suggest.

Sure the market can continue higher for some time, extending such divergences. However, eventually these conditions tend to get corrected. And the more egregious the divergence, the more corrective the action tends to be.

________

More from Dana Lyons, JLFMI and My401kPro.