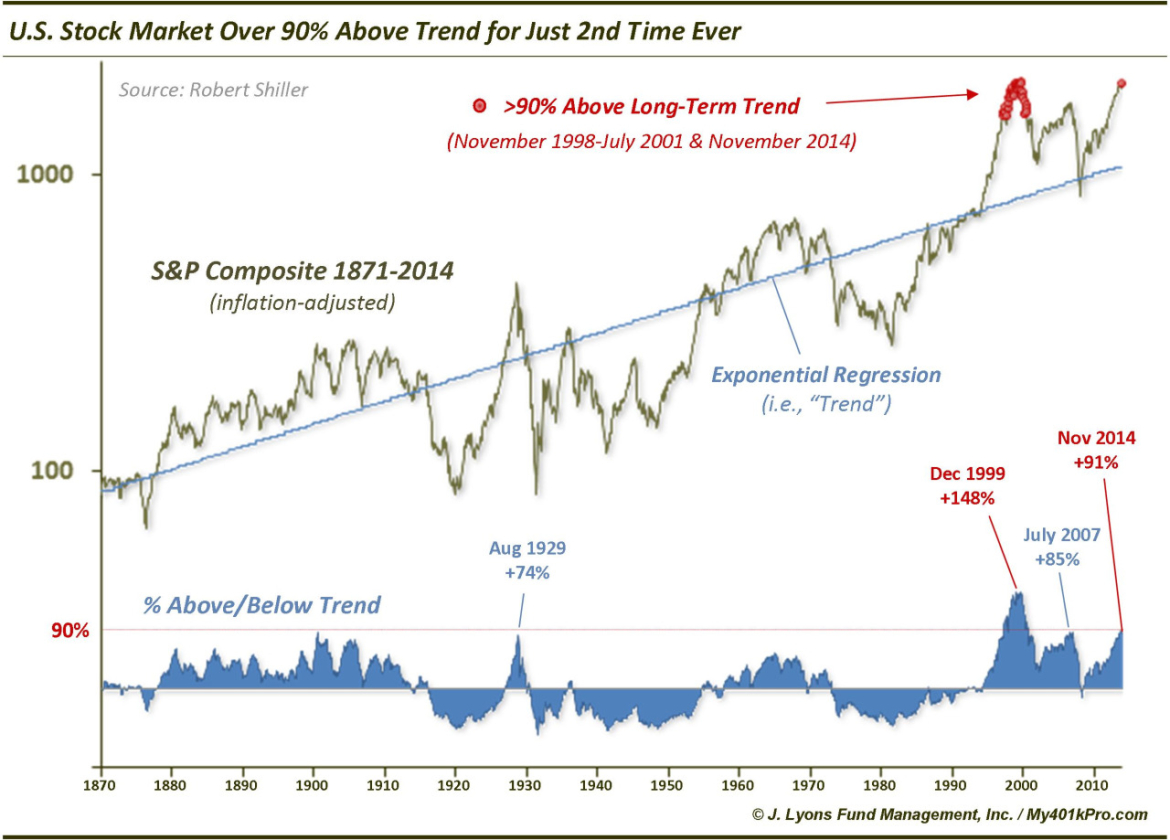

U.S. Stocks are 2nd Most Overbought In History

Everyone knows that, as a whole, the U.S. stock market is overbought. At the moment it doesn’t even matter what duration one is talking about, short, intermediate or long-term. But just how overbought is it? Today’s Chart Of The Day takes a look at the issue from 30,000 feet up. Measured against its long-term monthly trend since 1871, U.S. stocks are the 2nd most overbought in history. That is, if we can consider the stretch from November 1998 to July 2001 as one period. Outside of that period, stocks have never been this far above their long-term trend.

How do we arrive at that? We are using the inflation-adjusted S&P Composite data available from Robert Shiller’s site. This composite is essentially the current S&P 500 with re-engineered pricing prior to its inception in the 1950’s with available stock prices from the time. We used exponential regression smoothing to find the “best fit” trend line on the series since 1871 (h/t to Doug Short on this.)

After finding the best fit trend line for the composite, we can measure how far above or below prices are at a given time. As it turns out, outside of the afforementioned 1998-2001 period, November 2014 marks the first month in its entire history that the S&P Composite is 90% above its long-term trend.

So what does it mean? We aren’t going to go into a long essay on its implications. We and others have written extensively on long-term, or secular, cycles. (See our November newsletter published today for one example). Suffice it to say, the stock market is extended. Can it stay extended? The past few years prove that it can. They also prove, in our view, that the intermediate-term (i.e., from months to years) is the best time frame to focus on when considering investing.

I will only leave you with this: it likely is not the best time to commit a lot of long-term capital to the U.S. stock market. Sure, after reaching a similar overbought level in 1998, the market continued higher for another 20 months or so. So it is possible that the market continues higher unimpeded. However, looking historically, that period was an anomaly. If you are willing to bet on it happening again, go for it. If not, you may consider adopting measures, or managers, to aid in managing risk.

Just my .02.

____

Read more from Dana Lyons, JLFMI and My401kPro.