Big Gaps To New Highs Bring Short-Term Pain, Long-Term Gain

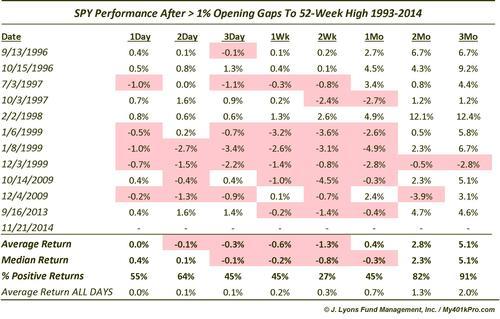

Lately it seems as though this market is producing unusual, and at times unprecedented, price action on a daily basis. Friday was no exception. Thanks to the surprise Chinese rate cut, the U.S. market gapped up sharply to all-time highs on the open. Using the S&P 500 SPDR (SPY) as a barometer, the gap up was just over 1% higher than the previous day’s close. While it isn’t unprecedented, by our count this is only the 12th time the SPY has gapped up by at least 1% to a 52-week high since its inception in 1993.

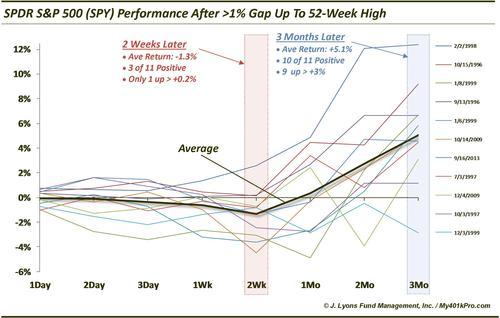

While there is no guarantee that this occurrence will lead to similar results, the market has followed a consistent path following the previous instances. Here are the forward returns, graphically, of each of them from 1 day to 3 months.

While the few days following the big gaps to new highs were a toss-up, by 2 weeks later, 8 of the 11 were lower than the close on the gap day, by an average of -1.3%. And only 1 of the 3 that were up was so by more than +0.18%. It isn’t surprising to see some giveback to such a large gap, but this is statistically very consistent.

Just as consistent has been the tendency for the SPY to rebound after 2 weeks and rally back to new highs. By 2 months out, 9 of the 11 were higher by an average of +2.8%. By 3 months out, only 1 of the occurrences was down and the overall average return was +5.1%. The only real loser was December 3, 1999 as the market was entering a topping pattern (though, the SPY did show a positive 6-month return following).

Here are the 11 dates and their respective returns.

Again, there is no guarantee that stocks will follow the same general pattern this time around. However, the historical tendencies do mesh with some of the other studies we’ve looked at recently that suggest a short-term cooling of the recent red-hot market, before making another run to new highs.

____

“The Place Where Water Runs Through Rocks” photo by Mark Stevens.

Read more from Dana Lyons, JLFMI and My401kPro.