Rising Junk Bond Yields Signaling Long-Term Trouble?

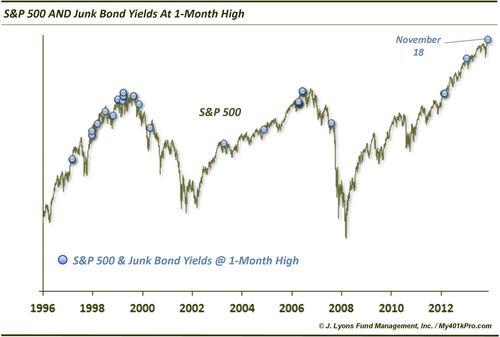

Many commentators have highlighted the potential warning signs related to the high yield, or “junk”, bond market. We have ourselves pointed to the troubling issues in the space, including record issuance, poor quality of the terms of many of the bonds and the recent drop in prices (rise in rates). Weakness like we’ve seen recently in junk bonds is unusual during rallies in the stock market. Indeed, the 2 markets reached a rare milestone on Tuesday. Both the S&P 500 and junk bond yields (BofA Merrill Lynch US High Yield Master II Effective Yield) hit a 1-month high on the same day.

One market cliche often parroted is that when the bond and stock markets diverge, the bonds are usually correct. Thus, the stock market usually ends up going the way of the bonds. Is there evidence to back that up? In this case, there appears to be, although perhaps not within the duration one might expect.

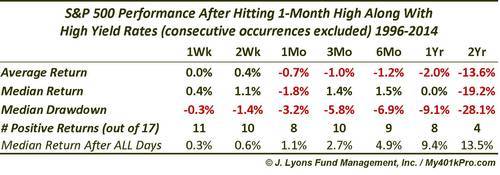

The S&P 500’s performance in the few weeks following these events was actually slightly above normal before slightly underperforming over the subsequent few weeks and months. Looking out long-term, however, we see where the stocks follow junk bonds lower as the S&P 500 displays startlingly poor returns. The median 2-year loss after these events is -19.2%! Bear in mind that these figures only include the first incident of clusters.

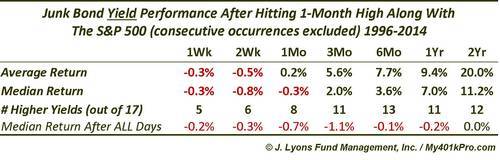

The action in junk bonds was similar.

In the short-term, prices rose slightly and yields dropped slightly, both roughly in line with their historical norm. Therefore, in the short-term, it appears that junk bonds have actually moved in the direction of stocks (i.e., up). However, by 3 months out, it is a different story as junk bonds begin to drop and junk yields spike. 2 years after these incidents, 12 of the 17 resulted in higher rates with a median rise of 11.2%

Obviously, the poor long-term returns in stocks (and junk bonds) are a product of many of these divergences occurring in the immediate buildup into the cyclical tops in 2000 and 2007. Therefore, unless it is merely a coincidence, the takeaway may be this: while these splits in junk bonds and stocks may not be an immediate roadblock to higher equity prices in the short-term, they may be indicative of a developing environment wherein the long-term economic and credit picture is deteriorating.

I guess we’ll find out in 2 years.

____

“Scrap” photo by Anthony Furlong.

Read more from Dana Lyons, JLFMI and My401kPro.