December Is The Least “Toppy” Month For Stocks

Seasonality in the market (i.e., price behavior based upon the calendar) is a widely misunderstood and misapplied tool. Too often it is assumed that the market will behave a certain way because of its “average” historical tendency. In reality, seasonality should normally be given only marginal consideration when applying an investment strategy. It should not be forgotten that these are “average” tendencies based on many years of data. In building those averages, there will have been many periods wherein the market performed much better than the average and many periods it performed worse. The specific circumstances at a given point in time will be most relevant in determining the market’s fate.

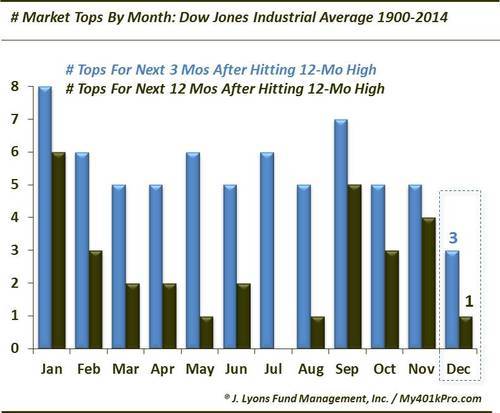

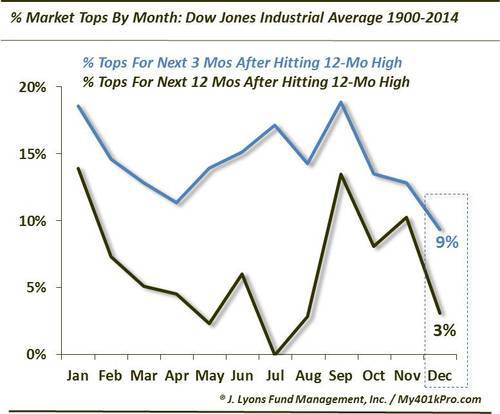

Given that disclaimer we offer today’s Chart Of The Day which looks at historical stock market topping tendencies based on the months of the year since 1900. Specifically, we looked at the number of times and percentage of time that the Dow Jones Industrial Average formed 3-month tops and 12-month tops after hitting a 12-month high within a given month. We found the data especially relevant at the present time considering December has historically been the least likely month to form a market top.

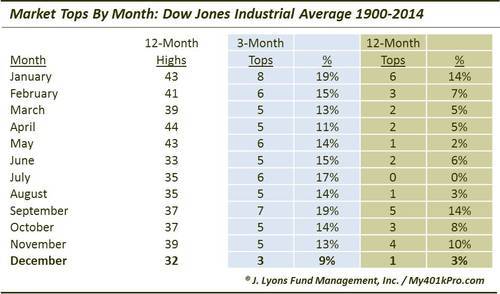

Since 1900, the Dow has only formed one 12-month top in December, in 1968. Only July had fewer, obviously with zero. No other month has formed fewer 3-month tops than December. There have only been 3 such tops formed in December since 1900. For the record, one of them did occur last year.

It should be noted that December has had the fewest 12-month highs recorded during the month of any of the 12 months. Therefore, the relatively few tops formed is not a surprise, perhaps. However, even on a percentage basis, it is the least toppy over 3 months and among the least toppy for 12 months.

Just 9% (3 of 32) of the time the Dow made a 12-month high in December did that high hold up for 3 months. And only 3% (1 of 32) of the time did it form a 12-month high (again, in 1968).

Here is the raw data on the Dow highs and tops by month.

So for those concerned that the Dow may have formed a top earlier this month, the historical evidence is not with you. This is true for the both the next 12 months and the next 3 months. Although again, this should only be treated as a marginal influence on the market’s destiny. It was only last December that we saw the market defy the odds and top out for the following 3 months.

We have plenty of concerns regarding the market right now, particularly over the long-term. However, judged solely on historical monthly tendencies, a “December top” is not one of them.

____

More from Dana Lyons, JLFMI and My401kPro.