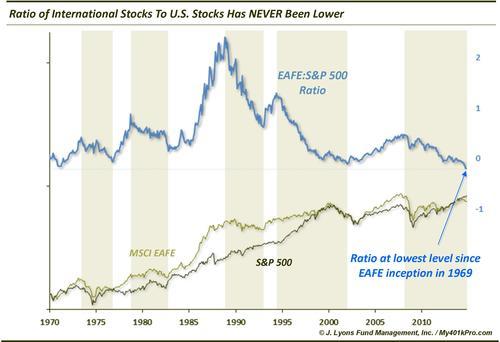

Foreign Stocks Have Never Been Weaker Relative To The U.S.

It’s no secret that the U.S. stock market has been the place to be over the past few years. Thanks to both the relentless rally in the U.S. and the struggles abroad, the relative out-performance of the U.S. has been stark. Just how badly have foreign stocks under-performed? Using the widely followed MSCI EAFE Index as a gauge, the relative performance has officially reached the bottom of the barrel since the EAFE’s inception in 1969.

Specifically, the ratio between the performance of the EAFE (which stands for Europe, Australasia and the Far East) and the S&P 500 hit an all-time low in November. A 45-year low should paint the picture pretty clearly regarding the magnitude of under-performance on the part of foreign stocks.

What’s the takeaway? One is the merit of riding the trends in relative strength, in this case sticking with U.S. stocks. Trends typically last longer than one thinks they will and indeed, relative trends between the EAFE and U.S. stocks have historically shown persistence.

Since 1969, there have been 5 distinct periods (the shaded areas in the chart) of cyclical under-performance by the EAFE relative to the U.S., including the current period. These periods of EAFE under-performance have lasted an average of 5 years. They have also produced a median under-performance of 6700 basis points versus the S&P 500. Currently, the EAFE is down 11% from its relative high versus the S&P 500 in 2008 while the S&P is up 55%.

The other takeaway that we should keep in mind is that the relative performance is cyclical. Periods of long under-performance have been followed by long periods of out-performance. The 4 intermittent cyclical periods of EAFE relative strength have lasted an average of nearly 4 years and produced a median out-performance by the EAFE of 7800 basis points.

Considering the current period of relative U.S. strength has lasted 6.5 years, foreign stocks are certainly “due”. However, the trend is one’s friend, as they say, and without question the relative strength in U.S. stocks is still the trend. That is the most important factor when considering these two market segments. That said, we should not be lulled into a false notion that the cycle won’t again turn eventually, despite how dark it may appear at the bottom of the barrel.

________

More from Dana Lyons, JLFMI and My401kPro.