Could The Philippines Be 2015’s Stock Market Of The Year?

While the U.S. has been the steady rock of the global equity world recently, each of the past few years has featured a foreign market that has been the standout for the year. In 2013, it was Japan rocketing 60% higher and in 2014, we gave the nod to India for its 30+% move to all-time highs (with all due respect to China’s 2nd half rally). What will 2015’s equity star be? One early candidate shaping up is the Philippines.

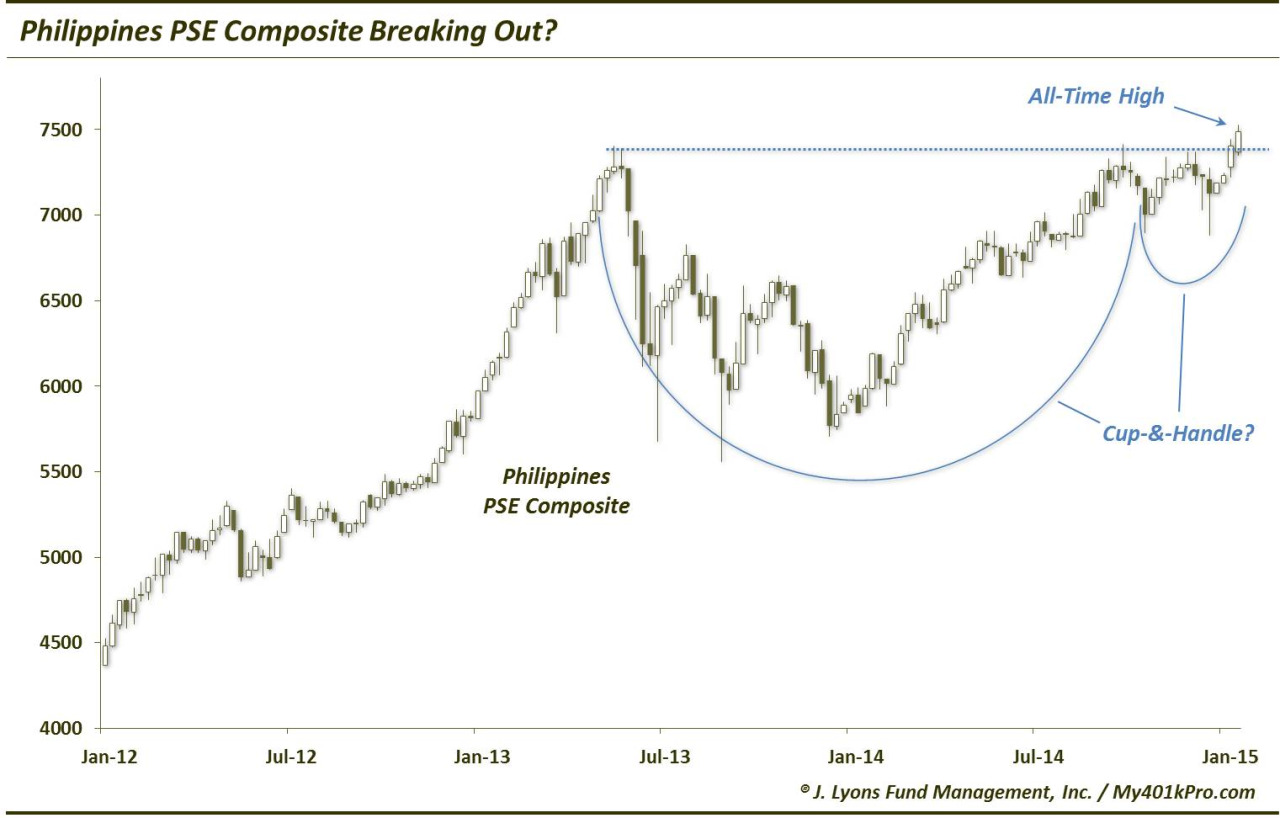

As shown in the first chart, the Philippines PSE Composite broke out to a new all-time high this week. This came after a strong rally from 2009 stalled out around 7500 in May 2013. After retreating from that area for over a year, the index tested those highs in September 2014 and again in November, forming a variant cup-&-handle formation. This action serves to chip away at former resistance before presumably breaking out to new highs, which the PSE has now done.

This breakout is reminiscent of India’s breakout last year in that it consolidated temporarily at the previous all-time highs before breaking out. Whether or not it follows through and runs higher like India did is the question. One difference is that India had bounced off the resistance at its all-time highs over a span of 6 years before breaking out. Also as we have seen across financial markets in the past two years, false breakouts have been as commonplace as successful breakouts. However, if the index displays strong follow through right away, the odds of a successful breakout are good.

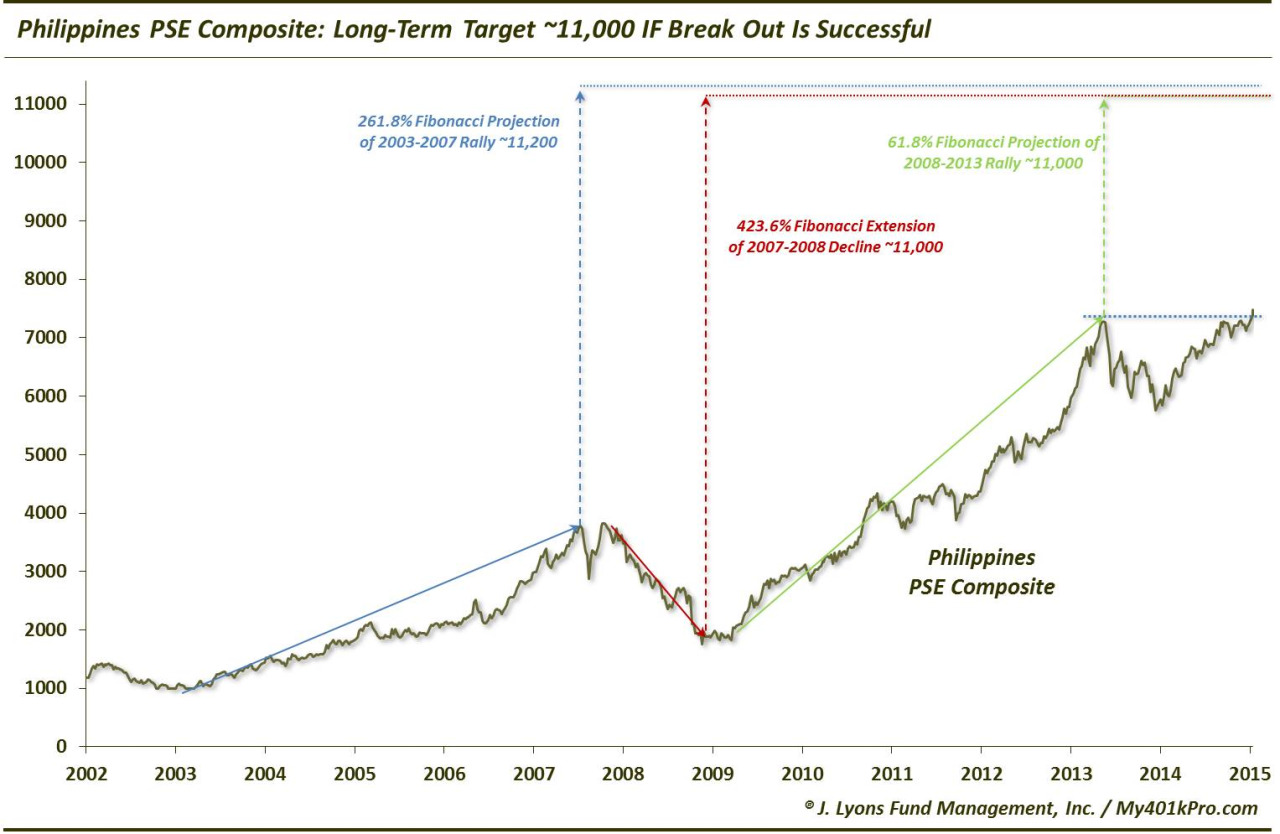

Should the breakout be legitimate, the long-term potential here is significant. Based on the following confluence of Fibonacci analysis, an eventual arrival at the 11,000 area is not out of the question. This would signify an approximate 47% gain from current prices:

- 261.8% Fibonacci Projection of 2003-2007 Rally ~11,200

- 61.8% Fibonacci Projection of 2008-2013 Rally ~11,000

- 423.6% Fibonacci Extension of 2007-2008 Decline ~11,000

We will keep a close eye on this breakout in coming days and weeks. If successful, the Philippines PSE Composite has long-term potential appreciation of almost 50% to the 11,000 level. It will also have the inside track for equity market of the year for 2015.

________

More from Dana Lyons, JLFMI and My401kPro.