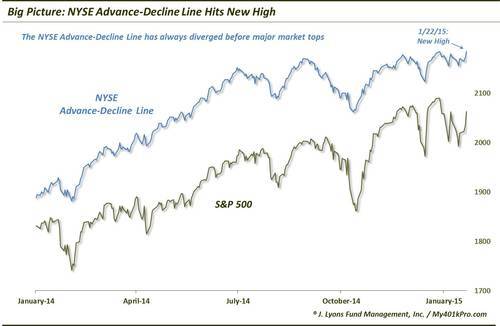

Are Bears Missing The Forest For The Trees?

With all of the concerns that we and others have mentioned recently regarding the current health of the stock market, sometimes the big picture can get lost. In our view, many of the concerns, whether short-term or longer-term, are absolutely legitimate or we wouldn’t bother to mention them. However, it is important to prioritize one’s investment decision inputs. And one of the most important “big picture” indicators – the NYSE Advance-Decline Line – is signaling not to be too concerned about the stock market just yet.

The NYSE Advance-Decline Line is a cumulative tally of the daily difference between all advancing issues and all declining issues on the NYSE. Thus, it is one of the broadest measures of breadth (i.e., advancing vs. declining stocks) covering the stock market. As readers may be aware, we are strong proponents of utilizing breadth as a measure of the health of the broad market. The more stocks going up, the healthier the market. Therefore, yesterday’s development which saw the NYSE A-D Line close at a new all-time high is significant.

So why does this development suggest we not be too concerned about the stock market rally at this point? Besides the obvious connotations of having the cumulative number of advancing minus declining issues at an all-time high, there is a historical relationship with the S&P 500 that implies good news for the market as well. Since we began tracking the NYSE A-D Line in 1965, it has peaked in advance of every major top in the S&P 500. These divergences have typically occurred several months prior to the ultimate market peak. Therefore, based on that track record, we can assume we are not yet near a top.

Of course, that does not mean the market cannot undergo a lesser sell off at any time. In fact there are several shorter-term breadth measures that we track which are not painting as rosy a picture for the market right now. However, even if the S&P 500 sold off, history would imply that it would eventually go to a new high (accompanied by a divergence in the A-D Line) before a final top is in.

So for all of the valid warnings and concerns regarding this market, it is important to keep perspective. Considering the new high in the NYSE Advance-Decline Line, those concerns appear to be merely trees at this time in an overall still healthy forest.

________

“Pine Forest” photo by Joshua Mayer.

More from Dana Lyons, JLFMI and My401kPro.